VIAC - the leading digital pension platform in Switzerland.

Why VIAC

Our not-so-secret ingredient? Automation✨

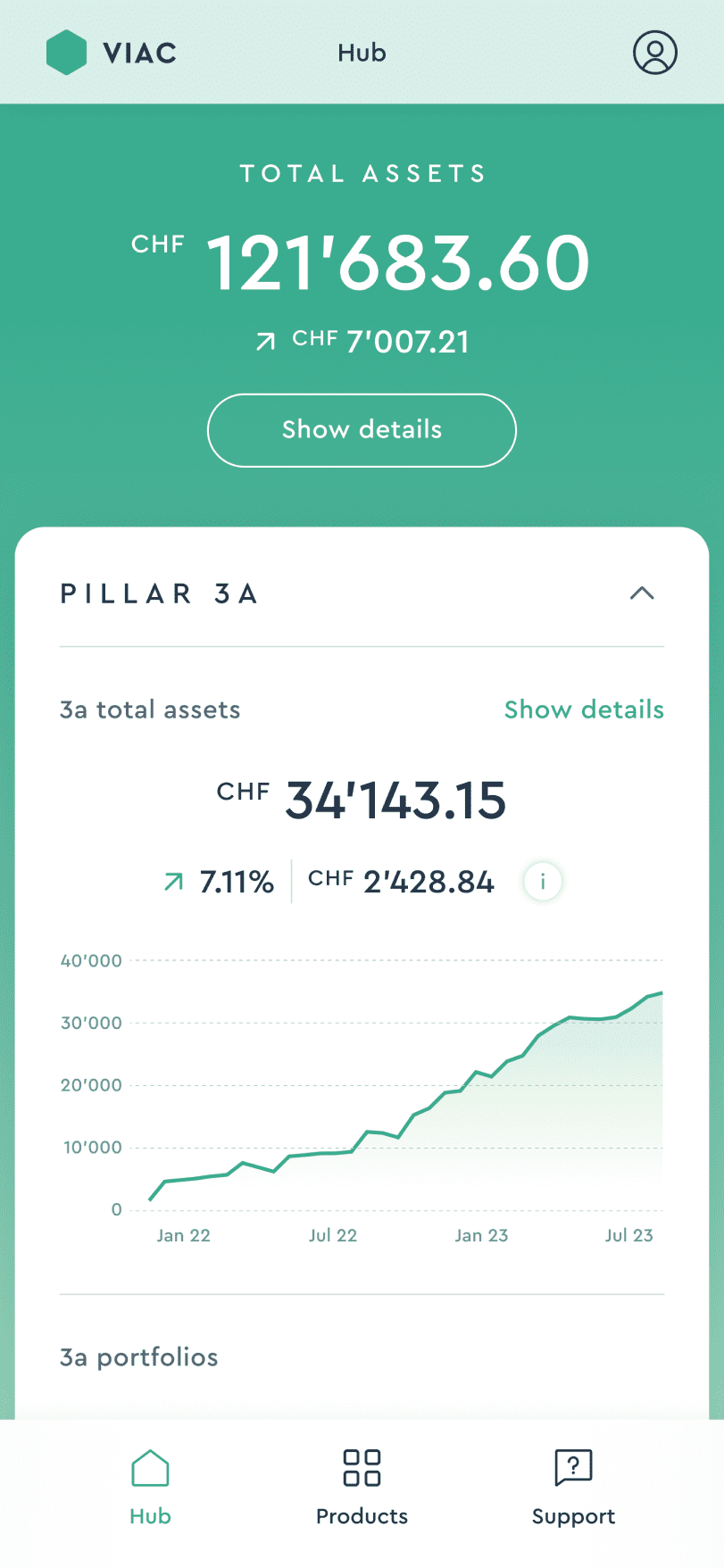

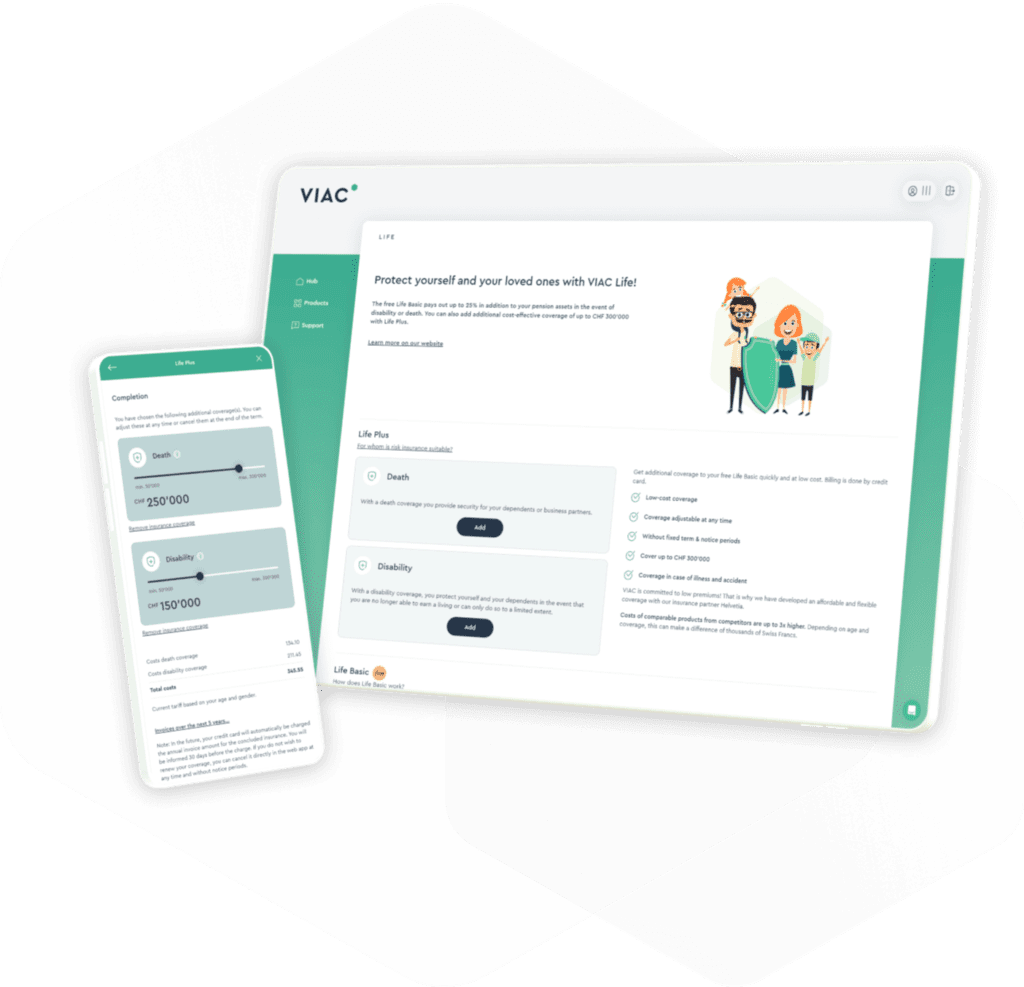

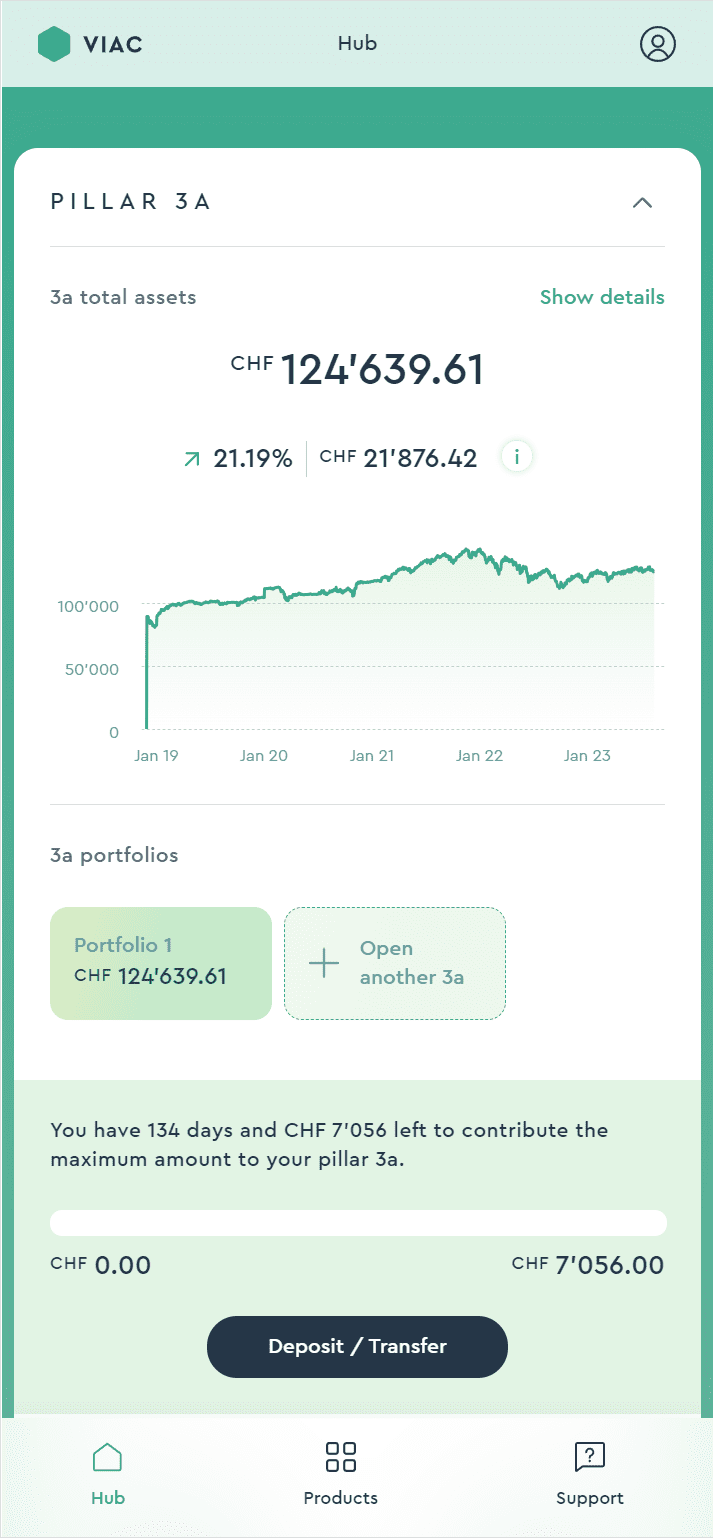

This frees up time for our customers. Our products are easy to access, offer a unique customer experience and impress with the best price/performance ratio. Track your investments with ease in the VIAC app – our powerful automation ensures your portfolio sticks to your plan. Our software automatically rebalances your investments as needed and handles all transactions.

See for yourself why VIAC is the best platform for your pillar 3a, vested benefits, mortgage or disability and death protection.

It's that simple

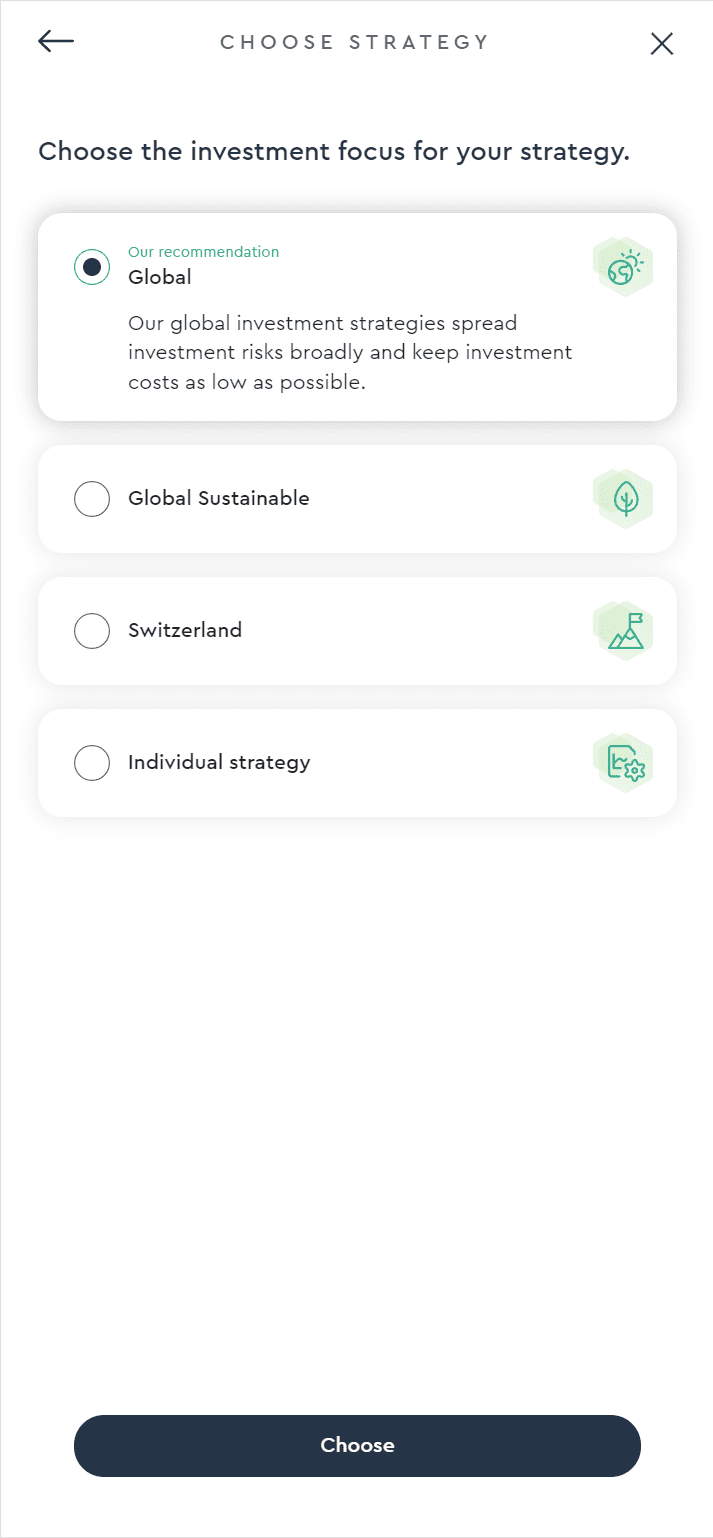

100% digital, on the smartphone, tablet or computer.

Opening takes less than 8 minutes. It’s easy and convenient to open anywhere. Even after the completion of the opening process, you decide at any time whether you want to deposit money or not.

From Switzerland for Switzerland

Maximum security for your finances

Everything from Switzerland

The entire software of the VIAC app is developed and operated in Switzerland.

Strict data protection

Your data will be stored with us in accordance with strict Swiss data protection laws.

Your customer support is some of the very best I have ever experienced. Congratulations at this point. Kind regards

Thanks for the info and the customer friendly support! This is exactly what customers want and what you can achieve with digital means! Awesome concept!

You can thank the whole VIAC team on my behalf. I am very satisfied with all the services and customer service. Top! I wish you all the best and a happy holiday.

Your service is incredibly fast and your app is super good. Congratulations on your achievement, which I have never experienced in the banking sector.

The two 3a accounts were transferred to our bank accounts yesterday. I would like to thank you very much for the uncomplicated and fast processing of our dossier. Keep up the good work!

Wow! Thank you for the super fast and uncomplicated feedback! (I’m used to something else from my old 3a account “provider”). But that’s why I have everything with you now.

Thank you very much, that was again a great service! I will gladly continue to recommend you.

Dear VIAC Team. I just wanted to thank you for the great service and the great facilities. I am a big fan and more than satisfied with VIAC! A really great thing. Thank you very much!

You guys are fast as lightning! Scandal!

Many thanks

Super thanks! Viac is always uncomplicated, customer-friendly, transparent and fast – which is something you don’t get from banks. Top for me!

Thank you and happy new year 2022.

Your website is amazing! Clear, simple and you do not have to look for the information in the basement together (as with certain competitors!). I like, convinces me.

The direct contact and the speedy clarification are brilliant! So it makes fun!

Have gained a new customer and will be very happy to transfer about 100’000.- to you.

Our partners

Strong partners for your fortune

Thanks to the cooperation between the established Terzo Pension Foundation and the WIR Bank Vested Benefits Foundation and the young start-up company VIAC, you have the best of both worlds: maximum security for your pension assets and a modern, customized implementation. No wishes remain unfulfilled!