Serial winner: 2019 to 2023 in the big pillar 3a fund comparison of Handelszeitung!

Strategies

Strategies Offered

The VIAC strategies have already been chosen several times as test winners by Handelszeitung and have been awarded top ratings! You too can rely on the excellent and cost-effective strategies of VIAC.

Strategies

Investment Focus: Global

| Strategy | Year-to-date | Total Costs* | Equity Weight | Life Basic** |

|---|---|---|---|---|

| 3a account (1.15% interest) | 0.3% | free | 0% | – |

| Account Plus Global | 1% | free | 5% | inclusive |

| Global 20 | 3.6% | 0.17% | 20% | inclusive |

| Global 40 | 6.1% | 0.28% | 40% | inclusive |

| Global 60 | 8.7% | 0.39% | 60% | inclusive |

| Global 80 | 10.9% | 0.41% | 80% | inclusive |

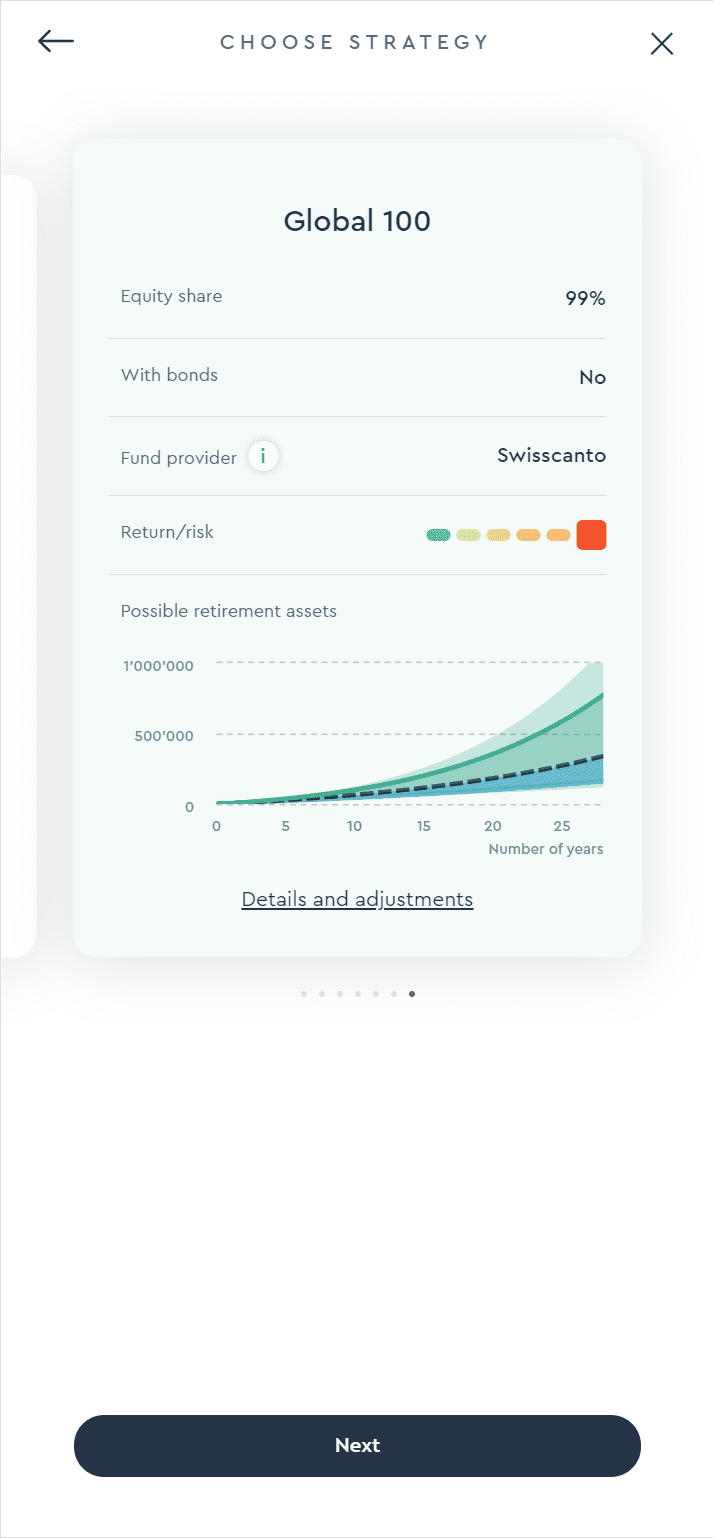

| Global 100 | 11.7% | 0.41% | 99% | inclusive |

| Strategy | Year-to-date | Total Costs* | Equity Weight | Life Basic** |

|---|---|---|---|---|

| 3a account (1.15% interest) | 0.3% | free | 0% | – |

| Account Plus Global | 1% | free | 5% | inclusive |

| Global 20 | 3.8% | 0.40% | 20% | inclusive |

| Global 40 | 6.3% | 0.41% | 40% | inclusive |

| Global 60 | 8.8% | 0.41% | 60% | inclusive |

| Global 80 | 11% | 0.41% | 80% | inclusive |

| Global 100 | 11.7% | 0.41% | 99% | inclusive |

| Strategy | Year-to-date | Total Costs* | Equity Weight | Life Basic** |

|---|---|---|---|---|

| 3a account (1.15% interest) | 0.3% | free | 0% | – |

| Account Plus Global | 1% | free | 5% | inclusive |

| Global 20 | 3.6% | 0.17% | 20% | inclusive |

| Global 40 | 6% | 0.28% | 40% | inclusive |

| Global 60 | 8.7% | 0.38% | 60% | inclusive |

| Global 80 | 10.9% | 0.40% | 80% | inclusive |

| Global 100 | 11.5% | 0.40% | 99% | inclusive |

| Strategy | Year-to-date | Total Costs* | Equity Weight | Life Basic** |

|---|---|---|---|---|

| 3a account (1.15% interest) | 0.3% | free | 0% | – |

| Account Plus Global | 1% | free | 5% | inclusive |

| Global 20 | 3.7% | 0.40% | 20% | inclusive |

| Global 40 | 6.2% | 0.40% | 40% | inclusive |

| Global 60 | 8.7% | 0.40% | 60% | inclusive |

| Global 80 | 10.8% | 0.40% | 80% | inclusive |

| Global 100 | 11.5% | 0.40% | 99% | inclusive |

Investment Focus: Switzerland

| Strategy | Year-to-date | Total Costs* | Equity Weight | Life Basic** |

|---|---|---|---|---|

| 3a account (1.15% interest) | 0.3% | free | 0% | – |

| Account Plus Schweiz | 0.7% | free | 5% | inclusive |

| Switzerland 20 | 2.9% | 0.17% | 20% | inclusive |

| Switzerland 40 | 4.5% | 0.28% | 40% | inclusive |

| Switzerland 60 | 6.3% | 0.39% | 60% | inclusive |

| Switzerland 80 | 8.3% | 0.42% | 80% | inclusive |

| Switzerland 100 | 8.7% | 0.43% | 99% | inclusive |

| Strategy | Year-to-date | Total Costs* | Equity Weight | Life Basic** |

|---|---|---|---|---|

| 3a account (1.15% interest) | 0.3% | free | 0% | – |

| Account Plus Schweiz | 0.7% | free | 5% | inclusive |

| Switzerland 20 | 3% | 0.40% | 20% | inclusive |

| Switzerland 40 | 4.7% | 0.40% | 40% | inclusive |

| Switzerland 60 | 6.4% | 0.41% | 60% | inclusive |

| Switzerland 80 | 8.2% | 0.42% | 80% | inclusive |

| Switzerland 100 | 8.7% | 0.43% | 99% | inclusive |

| Strategy | Year-to-date | Total Costs* | Equity Weight | Life Basic** |

|---|---|---|---|---|

| 3a account (1.15% interest) | 0.3% | free | 0% | – |

| Account Plus Schweiz | 0.7% | free | 5% | inclusive |

| Switzerland 20 | 2.8% | 0.17% | 20% | inclusive |

| Switzerland 40 | 4.5% | 0.28% | 40% | inclusive |

| Switzerland 60 | 6.2% | 0.38% | 60% | inclusive |

| Switzerland 80 | 8.1% | 0.41% | 80% | inclusive |

| Switzerland 100 | 8.5% | 0.43% | 99% | inclusive |

| Strategy | Year-to-date | Total Costs* | Equity Weight | Life Basic** |

|---|---|---|---|---|

| 3a account (1.15% interest) | 0.3% | free | 0% | – |

| Account Plus Schweiz | 0.7% | free | 5% | inclusive |

| Switzerland 20 | 2.9% | 0.40% | 20% | inclusive |

| Switzerland 40 | 4.6% | 0.40% | 40% | inclusive |

| Switzerland 60 | 6.2% | 0.40% | 60% | inclusive |

| Switzerland 80 | 8% | 0.41% | 80% | inclusive |

| Switzerland 100 | 8.5% | 0.43% | 99% | inclusive |

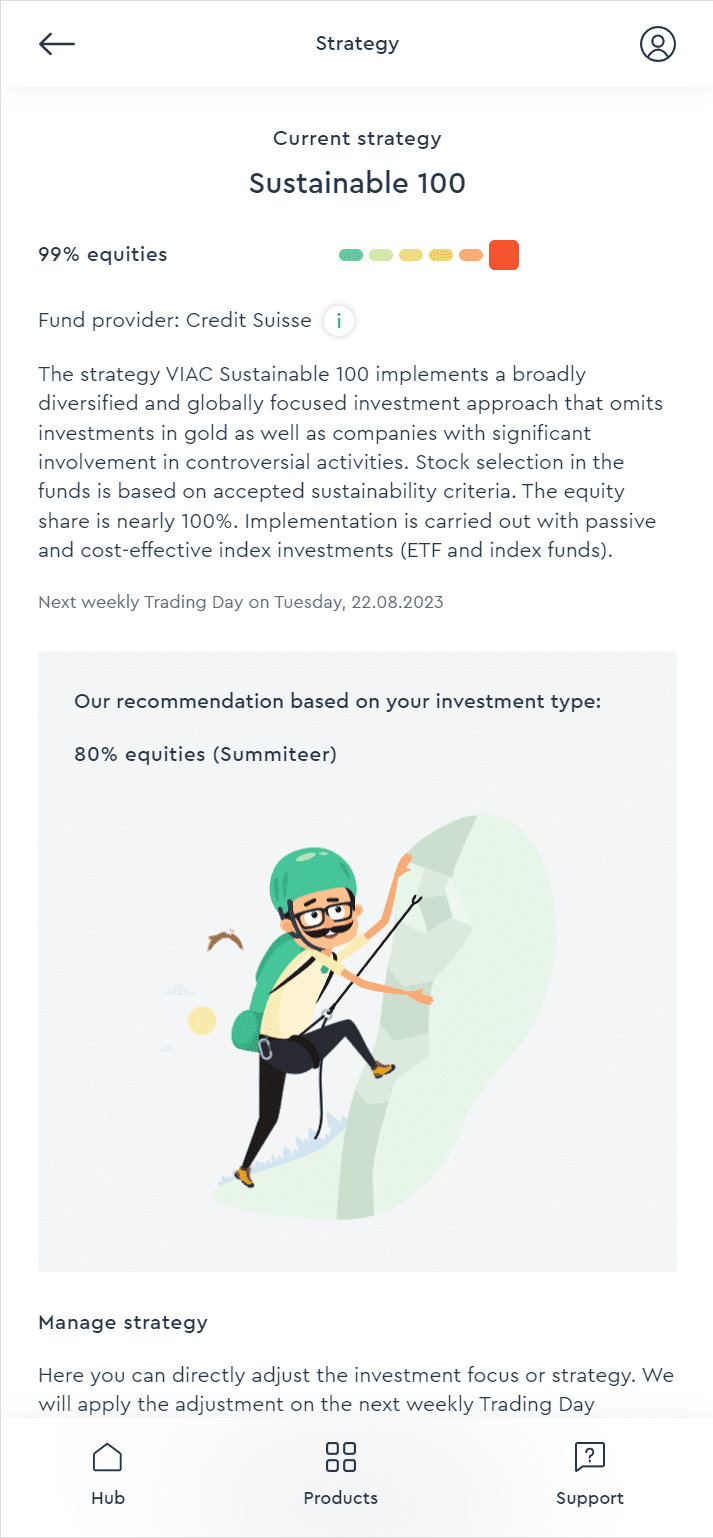

Investment Focus: Sustainable

| Strategy | Year-to-date | Total Costs* | Equity Weight | Life Basic** |

|---|---|---|---|---|

| 3a account (1.15% interest) | 0.3% | free | 0% | – |

| Account Plus Sustainable | 1% | free | 5% | inclusive |

| Global Sustainable 20 | 3.4% | 0.16% | 20% | inclusive |

| Global Sustainable 40 | 5.8% | 0.28% | 40% | inclusive |

| Global Sustainable 60 | 8.3% | 0.39% | 60% | inclusive |

| Global Sustainable 80 | 10.8% | 0.43% | 80% | inclusive |

| Global Sustainable 100 | 11.9% | 0.44% | 99% | inclusive |

| Strategy | Year-to-date | Total Costs* | Equity Weight | Life Basic** |

|---|---|---|---|---|

| 3a account (1.15% interest) | 0.3% | free | 0% | – |

| Account Plus Sustainable | 1% | free | 5% | inclusive |

| Global Sustainable 20 | 3.6% | 0.41% | 20% | inclusive |

| Global Sustainable 40 | 5.9% | 0.42% | 40% | inclusive |

| Global Sustainable 60 | 8.4% | 0.43% | 60% | inclusive |

| Global Sustainable 80 | 10.8% | 0.43% | 80% | inclusive |

| Global Sustainable 100 | 11.9% | 0.44% | 99% | inclusive |

| Strategy | Year-to-date | Total Costs* | Equity Weight | Life Basic** |

|---|---|---|---|---|

| 3a account (1.15% interest) | 0.3% | free | 0% | – |

| Account Plus Sustainable | 1% | free | 5% | inclusive |

| Global Sustainable 20 | 3.3% | 0.16% | 20% | inclusive |

| Global Sustainable 40 | 5.6% | 0.26% | 40% | inclusive |

| Global Sustainable 60 | 7.9% | 0.36% | 60% | inclusive |

| Global Sustainable 80 | 10.3% | 0.40% | 80% | inclusive |

| Global Sustainable 100 | 11.5% | 0.40% | 99% | inclusive |

| Strategy | Year-to-date | Total Costs* | Equity Weight | Life Basic** |

|---|---|---|---|---|

| 3a account (1.15% interest) | 0.3% | free | 0% | – |

| Account Plus Sustainable | 1% | free | 5% | inclusive |

| Global Sustainable 20 | 3.4% | 0.40% | 20% | inclusive |

| Global Sustainable 40 | 5.7% | 0.40% | 40% | inclusive |

| Global Sustainable 60 | 8.1% | 0.40% | 60% | inclusive |

| Global Sustainable 80 | 10.4% | 0.40% | 80% | inclusive |

| Global Sustainable 100 | 11.5% | 0.40% | 99% | inclusive |

* Total costs include the external product costs and the VIAC administration fee. The VIAC administration fee covers custody, administration and transactions and amounts to 0.52% per year. For a given strategy, the fee is charged only on the portion of assets that the strategy invests in equities, real estate, commodities, …, not on the portion of assets that the strategy assigns to the interest bearing savings account. As a result, strategies that invest more into the savings account have lower total costs. The effective administration fee is further limited to a maximum of 0.40% by the fee cap.

** In the event of disability or death, you receive up to 25% in addition to your pension assets. For every CHF 10’000 of assets invested in securities (calculated on the basis of the previous month), VIAC will provide you with free insurance coverage of CHF 2’500 (max. CHF 250’000) in the event of death or disability (70% – degree of disability). You can find more information in the app under the product VIAC Life.

Selection Process

The Terzo Pension Foundation of WIR Bank has applied the following selection criteria to determine the index investments used:

Benchmark

Each index investment is strongly oriented towards an underlying benchmark index. In order to ensure that the individual strategies are globally diversified and sensibly distributed according to asset classes and regions, the appropriate benchmark indices must be selected beforehand. Note that this preselection is not always obvious: For example, the SMI, SLI, SPI and SMIM all reflect the Swiss stock market, but they all differ greatly in terms of diversification and risk/return profile.

Tax Influences

In addition to quantitative criteria, tax influences also play an important role. Index funds are a major part of the investments used. These are not traded on the stock exchange and are therefore not subject to stamp duty. In the case of the remaining investment products (ETFs), stamp duty is due, but it is also reduced by VIAC’s intelligent offsetting system.

Quantitative Characteristics

In order to reflect the preselected benchmark indices as well and as cost-effectively as possible, the following quantitative criteria are used: product fees, trading liquidity, tracking error (deviation from the benchmark), and trading spread. These characteristics are regularly checked and guarantee an optimal and customer-oriented choice of the index investments used.

Replication

Last but not least, the type of replication also influences the selection. Where possible, physically replicated funds are implemented. They effectively invest in the stocks of the underlying benchmark index. Investments in synthetically replicating products are avoided if possible since they are exposed to counterparty risk.

Asset List

Liquidity

| Name | Details | ISIN | Currency | TER | Factsheet |

|---|---|---|---|---|---|

| 3a Account | Liquidity WIR Bank | – | CHF | – | – |

Bonds Switzerland

| Name | Details | ISIN | Currency | TER | Factsheet |

|---|---|---|---|---|---|

| CSIMF Money Market CHF | FTSE 3-Month CHF Eurodeposit | CH0031419960 | CHF | 0.00% | Factsheet |

| CSIF CH Bonds AAA-AA | SBI AAA-AA | CH0033846350 | CHF | 0.00% | Factsheet |

| CSIF CH Bonds Corporate | SBI Corporate | CH0281860111 | CHF | 0.00% | Factsheet |

| Swisscanto CH Bonds AAA-BBB 1-5 | SBI AAA-BBB 1-5 | CH0215803898 | CHF | 0.00% | Factsheet |

| Swisscanto CH Bonds Corporate Responsible | SBI Corporate | CH1117196035 | CHF | 0.00% | Factsheet |

Bonds World

| Name | Details | ISIN | Currency | TER | Factsheet |

|---|---|---|---|---|---|

| CSIF World ex CH Gov. Bonds | FTSE Non-CHF WGBI | CH0033210086 | USD | 0.01% | Factsheet |

| CSIF World ex CH Corp. Bonds | BBG Barcl. Glob. Aggr. Corp. ex CHF | CH0189955260 | USD | 0.00% | Factsheet |

| Swisscanto World ex CH Gov. Bonds hedged | FTSE Non-CHF WGBI hedged | CH0117045317 | CHF | 0.00% | Factsheet |

| Swisscanto World ex CH Corp. Bonds Resp. hedged | FTSE World Inv.-Grade Corp. hedged | CH1146980946 | CHF | 0.00% | Factsheet |

High-yield Bonds

| Name | Details | ISIN | Currency | TER | Factsheet |

|---|---|---|---|---|---|

| CS Global High Yield | BBG Barclays Global High Yield Corp. | LU0340004091 | USD | 0.12% | Factsheet |

| CSIF Emerging Market Bonds | JPM EMBI Global Diversified | CH0259132105 | USD | 0.08% | Factsheet |

| Swisscanto Emerging Market Bonds hedged | JPM EMBI Global Diversified hedged | CH0398970274 | CHF | 0.00% | Factsheet |

| Swisscanto World ex JPY/CHF Infl. Linked hedged | FTSE ex JPY Glob. Infl. Link. hedged | CH0117048352 | CHF | 0.00% | Factsheet |

Equity Switzerland

| Name | Details | ISIN | Currency | TER | Factsheet |

|---|---|---|---|---|---|

| CSIF SMI | SMI | CH0033782431 | CHF | 0.00% | Factsheet |

| UBS ETF SLI | SLI | CH0032912732 | CHF | 0.20% | Factsheet |

| CSIF SPI Extra | SPI Extra | CH0110869143 | CHF | 0.00% | Factsheet |

| UBS ETF MSCI Switzerland IMI SRI | MSCI Switzerland SRI | CH0368190739 | CHF | 0.28% | Factsheet |

| CSIF SPI ESG | SPI ESG | CH0597394516 | CHF | 0.01% | Factsheet |

| Swisscanto SMI (SPI 20) | SPI 20 | CH0215804714 | CHF | 0.00% | Factsheet |

| Swisscanto SPI Extra | SPI Extra | CH0132501898 | CHF | 0.00% | Factsheet |

| Swisscanto SPI Responsible | SPI | CH0451461963 | CHF | 0.00% | Factsheet |

Equity Developed Markets

| Name | Details | ISIN | Currency | TER | Factsheet |

|---|---|---|---|---|---|

| CSIF Europe ex CH | MSCI Europe ex CH | CH0037606552 | EUR | 0.01% | Factsheet |

| CSIF US – Pension Fund | MSCI USA | CH0030849712 | USD | 0.00% | Factsheet |

| iShares Core S&P 500 | S&P 500 | IE00B5BMR087 | USD | 0.07% | Factsheet |

| iShares Nasdaq 100 | Nasdaq 100 | IE00B53SZB19 | USD | 0.33% | Factsheet |

| CSIF Canada | MSCI Canada | CH0030849613 | CAD | 0.01% | Factsheet |

| CSIF Pacific ex Japan | MSCI Pacific ex Japan | CH0030849654 | USD | 0.00% | Factsheet |

| CSIF Japan – PF | MSCI Japan | CH0357515474 | JPY | 0.01% | Factsheet |

| CS Global Dividend Plus | MSCI World | LU0439730705 | USD | 0.12% | Factsheet |

| CSIF World ex CH – PF Plus | MSCI World ex CH | CH0429081620 | USD | 0.00% | Factsheet |

| CSIF World ex CH hedged – PF Plus | MSCI World ex CH | CH0429081638 | CHF | 0.00% | Factsheet |

| CSIF World ex CH Small Cap – PF | MSCI World ex CH Small Cap | CH0214967314 | USD | 0.09% | Factsheet |

| CSIF World ex CH Small Cap hedged – PF | MSCI World ex CH Small Cap | CH0214968353 | CHF | 0.09% | Factsheet |

| Swisscanto Europe ex CH | MSCI Europe ex CH | CH0117044658 | EUR | 0.00% | Factsheet |

| Swisscanto US – IPF | MSCI USA | CH0117044732 | USD | 0.00% | Factsheet |

| Swisscanto Canada | MSCI Canada | CH0117044864 | CAD | 0.00% | Factsheet |

| Swisscanto Japan – IPF | MSCI Japan | CH0489405321 | JPY | 0.00% | Factsheet |

| Swisscanto Pacific ex Japan | MSCI Pacific ex Japan | CH0117044831 | USD | 0.00% | Factsheet |

| Swisscanto World ex CH – IPF | MSCI World ex CH | CH0117044948 | USD | 0.00% | Factsheet |

| Swisscanto World ex CH hedged – IPF | MSCI World ex CH | CH0296590281 | CHF | 0.00% | Factsheet |

| UBS ETF MSCI EMU SRI | MSCI EMU SRI | LU0629460675 | EUR | 0.22% | Factsheet |

| UBS ETF MSCI UK IMI SRI | MSCI UK IMI SRI | IE00BMP3HN93 | GBP | 0.28% | Factsheet |

| CSIF US ESG – PF | MSCI USA ESG Leaders | CH0397628709 | USD | 0.02% | Factsheet |

| UBS ETF MSCI USA SRI | MSCI USA SRI | LU0629460089 | USD | 0.22% | Factsheet |

| UBS ETF MSCI Pacific SRI | MSCI Pacific SRI | LU0629460832 | USD | 0.40% | Factsheet |

| CSIF World ex CH ESG – PF Plus | MSCI World ex CH ESG Leaders | CH0337393745 | USD | 0.03% | Factsheet |

| CSIF World ex CH ESG hedged – PF Plus | MSCI World ex CH ESG Leaders | CH0337393851 | CHF | 0.03% | Factsheet |

| iShares Global Clean Energy | S&P Global Clean Energy | IE00B1XNHC34 | USD | 0.65% | Factsheet |

| Swisscanto US Responsible – IPF | MSCI USA | CH1223932505 | USD | 0.00% | Factsheet |

| Swisscanto World ex CH Responsible – IPF | MSCI World ex CH | CH0215804755 | USD | 0.00% | Factsheet |

| Swisscanto World ex CH Resp. hedged – IPF | MSCI World ex CH | CH0293345648 | CHF | 0.00% | Factsheet |

| Swisscanto World ex CH Small Cap Resp. – IPF | MSCI World ex CH Small Cap | CH1220910934 | USD | 0.00% | Factsheet |

| Swisscanto World ex CH Sm. Cap Resp. hedged IPF | MSCI World ex CH Small Cap | CH1221211753 | CHF | 0.00% | Factsheet |

Equity Emerging Markets

| Name | Details | ISIN | Currency | TER | Factsheet |

|---|---|---|---|---|---|

| CSIF Emerging Markets | MSCI Em. Markets | CH0017844686 | USD | 0.09% | Factsheet |

| CSIF China Total Market | MSCI China | LU1815001406 | USD | 0.13% | Factsheet |

| UBS ETF MSCI Emerging Markets SRI | MSCI Em. Markets SRI | LU1048313891 | USD | 0.27% | Factsheet |

| Swisscanto Emerging Markets | MSCI Em. Markets | CH0117044971 | USD | 0.00% | Factsheet |

| Swisscanto Emerging Markets Responsible | MSCI Em. Markets | CH0561458693 | USD | 0.00% | Factsheet |

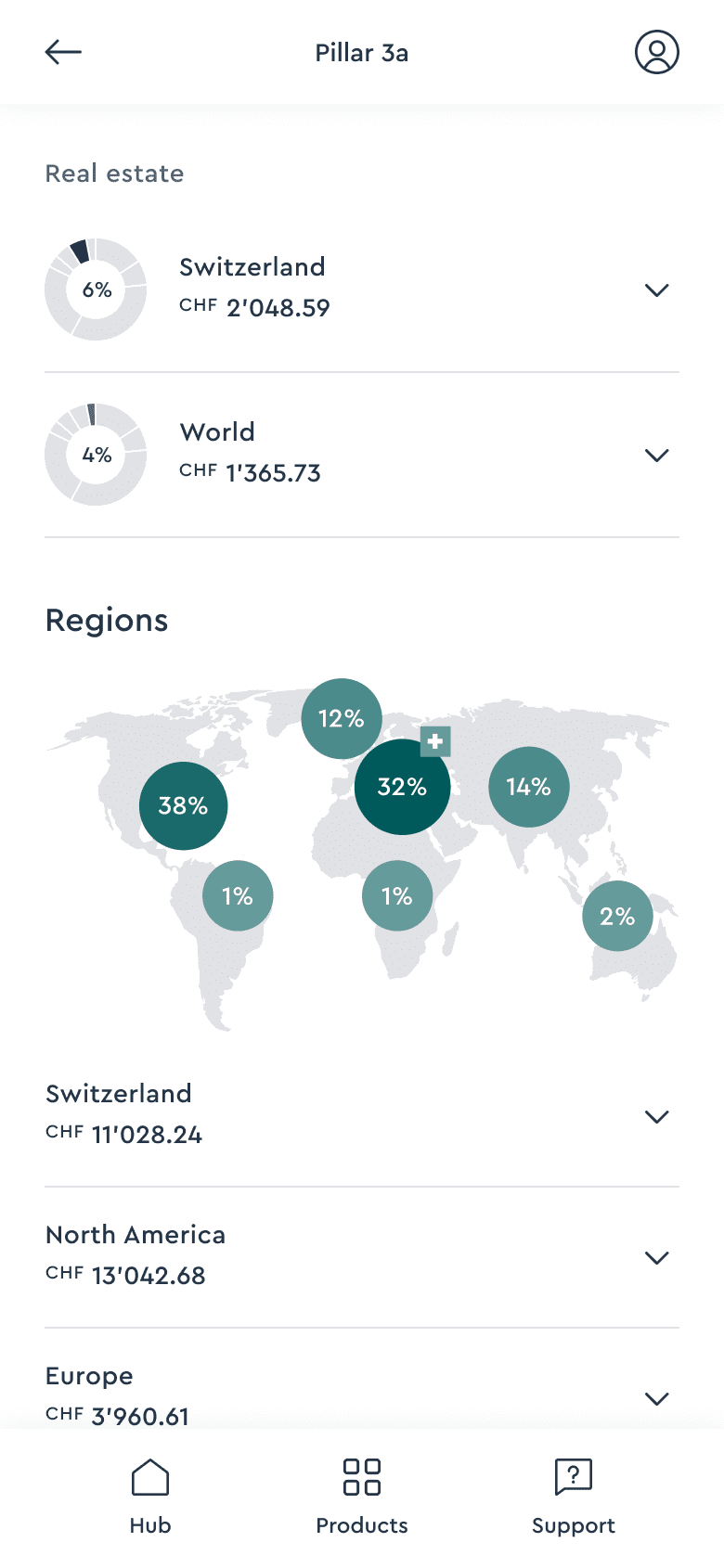

Real Estate Switzerland

Real Estate World

| Name | Details | ISIN | Currency | TER | Factsheet |

|---|---|---|---|---|---|

| iShares US Property Yield | FTSE EPRA Nareit US | IE00B1FZSF77 | USD | 0.40% | Factsheet |

| CSIF Real Estate World ex CH – Pension Fund | FTSE EPRA Nareit Dev. ex CH | CH0217837456 | USD | 0.01% | Factsheet |

| Swisscanto Europe ex CH Real Estate | FTSE EPRA Nareit Dev. Europe ex CH | CH0117052586 | EUR | 0.01% | Factsheet |

| Swisscanto North America Real Estate – IPF | FTSE EPRA Nareit North America | CH0215804730 | USD | 0.00% | Factsheet |

| Swisscanto Asia Real Estate | FTSE EPRA Nareit Developed Asia | CH0117052669 | CHF | 0.00% | Factsheet |

Commodities

* The «CSIF CH Real Estate» and «Swisscanto CH Real Estate» funds each have a TER of 0.00%. Both invest in real estate funds that are part of the SXI Real Estate Funds Broad Total Return Index. These real estate funds have TER costs, which are shown in the factsheet under «Ongoing charges» respectively «Total Expense Ratio p.a.».