Stratégies VIAC primées à plusieurs reprises

Stratégies

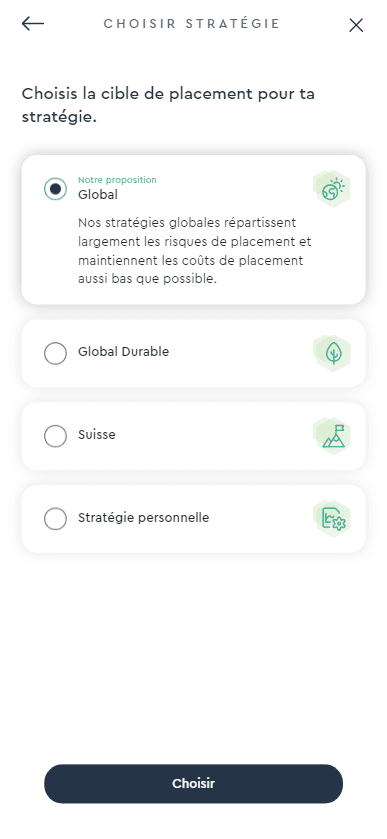

Stratégies proposées

Les stratégies de placement primées à plusieurs reprises sont également à ta disposition pour ton libre passage:

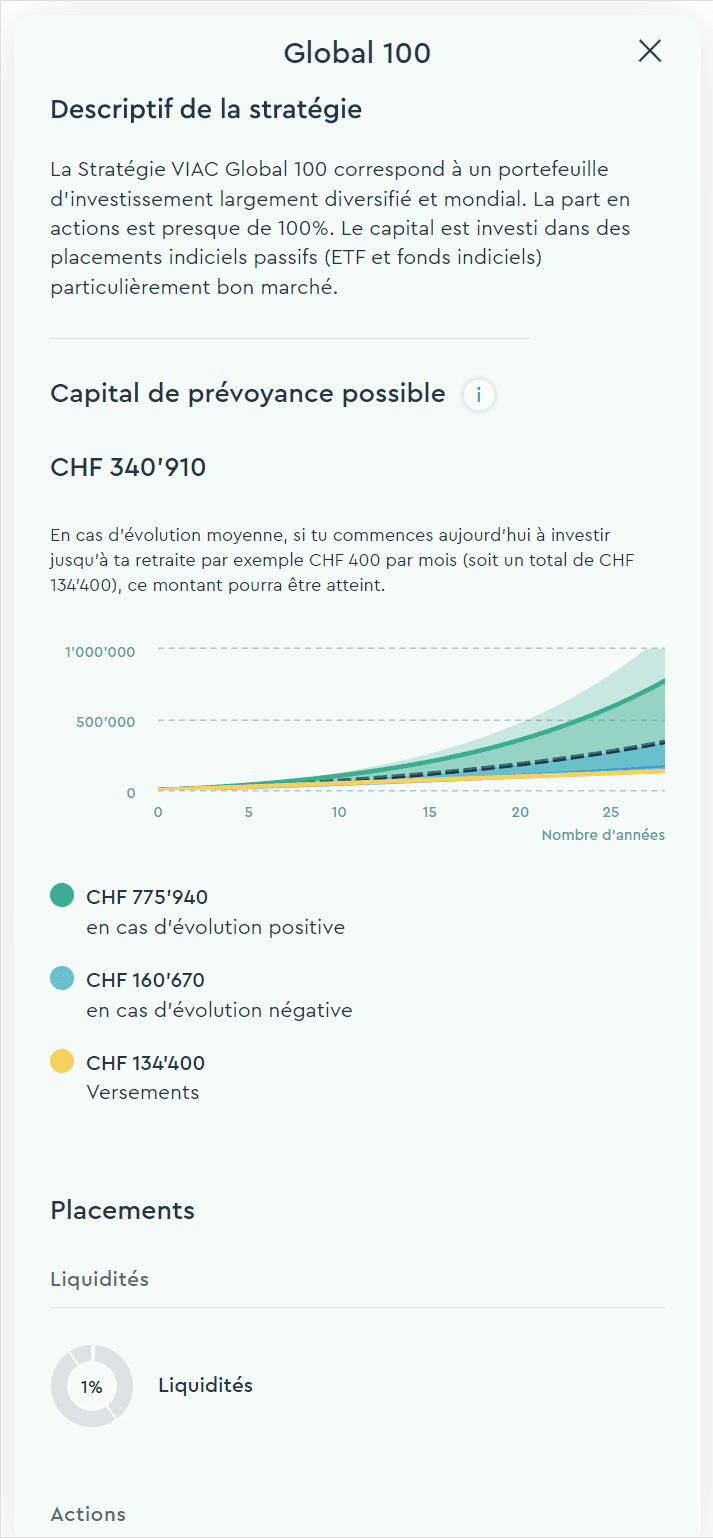

Cible de placement: Global

| Stratégie | Year-to-date | Commission totale* | Pondération actions | Life Basic** |

|---|---|---|---|---|

| Compte LP (0.65% intérêt) | 0.2% | sans frais | 0% | – |

| Compte Plus Global | 0.9% | sans frais | 5% | inclus |

| Global 20 | 3.6% | 0.17% | 20% | inclus |

| Global 40 | 6.1% | 0.28% | 40% | inclus |

| Global 60 | 8.7% | 0.39% | 60% | inclus |

| Global 80 | 10.9% | 0.41% | 80% | inclus |

| Global 100[1] | 11.7% | 0.41% | 99% | inclus |

| Stratégie | Year-to-date | Commission totale* | Pondération actions | Life Basic** |

|---|---|---|---|---|

| Compte LP (0.65% intérêt) | 0.2% | sans frais | 0% | – |

| Compte Plus Global | 0.9% | sans frais | 5% | inclus |

| Global 20 | 3.8% | 0.40% | 20% | inclus |

| Global 40 | 6.3% | 0.41% | 40% | inclus |

| Global 60 | 8.8% | 0.41% | 60% | inclus |

| Global 80 | 11% | 0.41% | 80% | inclus |

| Global 100[1] | 11.7% | 0.41% | 99% | inclus |

| Stratégie | Year-to-date | Commission totale* | Pondération actions | Life Basic** |

|---|---|---|---|---|

| Compte LP (0.65% intérêt) | 0.2% | sans frais | 0% | – |

| Compte Plus Global | 0.9% | sans frais | 5% | inclus |

| Global 20 | 3.5% | 0.17% | 20% | inclus |

| Global 40 | 6% | 0.28% | 40% | inclus |

| Global 60 | 8.6% | 0.38% | 60% | inclus |

| Global 80 | 10.9% | 0.40% | 80% | inclus |

| Global 100[1] | 11.5% | 0.40% | 99% | inclus |

| Stratégie | Year-to-date | Commission totale* | Pondération actions | Life Basic** |

|---|---|---|---|---|

| Compte LP (0.65% intérêt) | 0.2% | sans frais | 0% | – |

| Compte Plus Global | 0.9% | sans frais | 5% | inclus |

| Global 20 | 3.7% | 0.40% | 20% | inclus |

| Global 40 | 6.2% | 0.40% | 40% | inclus |

| Global 60 | 8.7% | 0.40% | 60% | inclus |

| Global 80 | 10.8% | 0.40% | 80% | inclus |

| Global 100[1] | 11.5% | 0.40% | 99% | inclus |

Cible de placement: Suisse

| Stratégie | Year-to-date | Commission totale* | Pondération actions | Life Basic** |

|---|---|---|---|---|

| Compte LP (0.65% intérêt) | 0.2% | sans frais | 0% | – |

| Compte Plus Suisse | 0.6% | sans frais | 5% | inclus |

| Suisse 20 | 2.8% | 0.17% | 20% | inclus |

| Suisse 40 | 4.5% | 0.28% | 40% | inclus |

| Suisse 60 | 6.3% | 0.39% | 60% | inclus |

| Suisse 80 | 8.2% | 0.42% | 80% | inclus |

| Suisse 100[1] | 8.7% | 0.43% | 99% | inclus |

| Stratégie | Year-to-date | Commission totale* | Pondération actions | Life Basic** |

|---|---|---|---|---|

| Compte LP (0.65% intérêt) | 0.2% | sans frais | 0% | – |

| Compte Plus Suisse | 0.6% | sans frais | 5% | inclus |

| Suisse 20 | 3% | 0.40% | 20% | inclus |

| Suisse 40 | 4.7% | 0.40% | 40% | inclus |

| Suisse 60 | 6.4% | 0.41% | 60% | inclus |

| Suisse 80 | 8.2% | 0.42% | 80% | inclus |

| Suisse 100[1] | 8.7% | 0.43% | 99% | inclus |

| Stratégie | Year-to-date | Commission totale* | Pondération actions | Life Basic** |

|---|---|---|---|---|

| Compte LP (0.65% intérêt) | 0.2% | sans frais | 0% | – |

| Compte Plus Suisse | 0.6% | sans frais | 5% | inclus |

| Suisse 20 | 2.7% | 0.17% | 20% | inclus |

| Suisse 40 | 4.4% | 0.28% | 40% | inclus |

| Suisse 60 | 6.1% | 0.38% | 60% | inclus |

| Suisse 80 | 8.1% | 0.41% | 80% | inclus |

| Suisse 100[1] | 8.5% | 0.43% | 99% | inclus |

| Stratégie | Year-to-date | Commission totale* | Pondération actions | Life Basic** |

|---|---|---|---|---|

| Compte LP (0.65% intérêt) | 0.2% | sans frais | 0% | – |

| Compte Plus Suisse | 0.6% | sans frais | 5% | inclus |

| Suisse 20 | 2.9% | 0.40% | 20% | inclus |

| Suisse 40 | 4.6% | 0.40% | 40% | inclus |

| Suisse 60 | 6.2% | 0.40% | 60% | inclus |

| Suisse 80 | 8% | 0.41% | 80% | inclus |

| Suisse 100[1] | 8.5% | 0.43% | 99% | inclus |

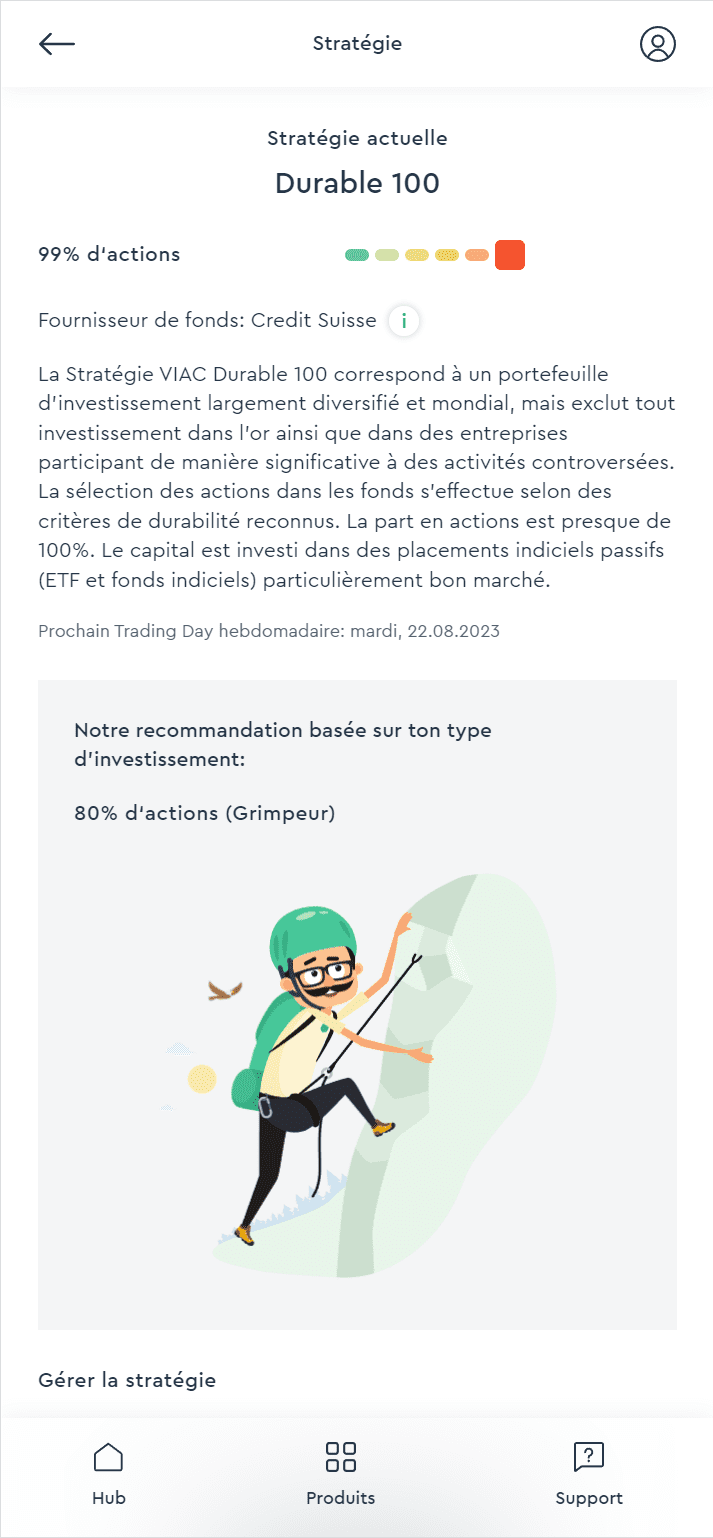

Cible de placement: Durable

| Stratégie | Year-to-date | Commission totale* | Pondération actions | Life Basic** |

|---|---|---|---|---|

| Compte LP (0.65% intérêt) | 0.2% | sans frais | 0% | – |

| Compte Plus Durable | 0.9% | sans frais | 5% | inclus |

| Global Durable 20 | 3.3% | 0.16% | 20% | inclus |

| Global Durable 40 | 5.7% | 0.27% | 40% | inclus |

| Global Durable 60 | 8.3% | 0.38% | 60% | inclus |

| Global Durable 80 | 10.9% | 0.42% | 80% | inclus |

| Global Durable 100[1] | 12.1% | 0.43% | 99% | inclus |

| Stratégie | Year-to-date | Commission totale* | Pondération actions | Life Basic** |

|---|---|---|---|---|

| Compte LP (0.65% intérêt) | 0.2% | sans frais | 0% | – |

| Compte Plus Durable | 0.9% | sans frais | 5% | inclus |

| Global Durable 20 | 3.6% | 0.41% | 20% | inclus |

| Global Durable 40 | 6% | 0.41% | 40% | inclus |

| Global Durable 60 | 8.5% | 0.42% | 60% | inclus |

| Global Durable 80 | 11% | 0.42% | 80% | inclus |

| Global Durable 100[1] | 12.1% | 0.43% | 99% | inclus |

| Stratégie | Year-to-date | Commission totale* | Pondération actions | Life Basic** |

|---|---|---|---|---|

| Compte LP (0.65% intérêt) | 0.2% | sans frais | 0% | – |

| Compte Plus Durable | 0.8% | sans frais | 5% | inclus |

| Global Durable 20 | 3.2% | 0.16% | 20% | inclus |

| Global Durable 40 | 5.5% | 0.26% | 40% | inclus |

| Global Durable 60 | 7.9% | 0.36% | 60% | inclus |

| Global Durable 80 | 10.3% | 0.40% | 80% | inclus |

| Global Durable 100[1] | 11.5% | 0.40% | 99% | inclus |

| Stratégie | Year-to-date | Commission totale* | Pondération actions | Life Basic** |

|---|---|---|---|---|

| Compte LP (0.65% intérêt) | 0.2% | sans frais | 0% | – |

| Compte Plus Durable | 0.8% | sans frais | 5% | inclus |

| Global Durable 20 | 3.4% | 0.40% | 20% | inclus |

| Global Durable 40 | 5.7% | 0.40% | 40% | inclus |

| Global Durable 60 | 8.1% | 0.40% | 60% | inclus |

| Global Durable 80 | 10.4% | 0.40% | 80% | inclus |

| Global Durable 100[1] | 11.5% | 0.40% | 99% | inclus |

* La commission totale inclut les frais de gestion de VIAC ainsi que les coûts externes des produits. Les frais de gestion VIAC couvrent tous les frais de dépôt, d’administration et de transaction et s’élèvent à 0.52% par an. Les frais de gestion ne sont toutefois prélevés que sur la partie de la fortune que la stratégie investit en actions, en immobilier, en matières premières, …, et non sur la partie de la fortune que la stratégie affecte au compte d’épargne rémunéré. Il en résulte que les stratégies ayant une part de liquidités plus importante ont des frais totaux plus faibles. Les frais de gestion effectifs sont en outre limités à 0.40% maximum par le plafonnement des frais.

** Tu reçois désormais jusqu’à 25% en plus de tes avoirs de prévoyance en cas d’invalidité ou de décès. Pour chaque CHF 10’000 d’avoirs investis dans des titres (calculé sur la base du mois précédent), VIAC t’offre une couverture d’assurance gratuite de CHF 2’500 (max. CHF 250’000) en cas de décès ou d’invalidité (70% – degré d’invalidité). Tu trouves plus d’informations dans l’application sous le produit VIAC Life.

[1] Les stratégies d’actions pures ne peuvent être sélectionnées que pour le segment surobligatoire.

Processus de sélection

La Fondation de libre passage de la Banque WIR a sélectionné les fonds indiciels en fonction des critères suivants:

Indices de référence

Un fonds indiciel est un fonds qui dépend d’un indice de référence sous-jacent. Il faut donc sélectionner des indices de référence adéquats pour diversifier judicieusement les stratégies au niveau mondial, tant au niveau des types de placement que de la répartition géographique. Cette présélection n’est pas toujours évidente: ainsi, les indices SMI, SLI, SPI et SMIM représentent tous le marché suisse des actions, mais ils se démarquent nettement les uns des autres en termes de diversification et de profil risque-rendement.

Facteurs fiscaux

Outre les critères quantitatifs, les facteurs fiscaux jouent eux aussi un rôle important. Les placements sont constitués en grande partie de fonds indiciels, qui sont exonérés du droit de timbre parce qu’ils ne sont pas négociés en bourse. Les placements restants (ETF) sont certes soumis au droit de timbre, mais à un taux préférentiel, grâce à la facturation intelligente de VIAC.

Critères quantitatifs

Les indices de référence présélectionnés sont considérés à travers les critères quantitatifs suivants: frais de gestion externes, liquidités des titres, suivi des écarts par rapport à l’indice de référence, et écarts de négociation. Ces critères sont régulièrement vérifiés pour garantir une sélection optimale et ciblée des fonds indiciels utilisés.

Réplication

Enfin, le mode de réplication influence également la sélection. VIAC recourt dans toute la mesure du possible à des fonds répliqués physiquement, qui investissent réellement dans les titres de l’indice de référence sous-jacent. Dans la mesure du possible, VIAC renonce à investir dans des produits répliqués synthétiquement, puisque ceux-ci souffrent du risque de contrepartie.

Liste des titres

Liquidités

| Nom | Détails | ISIN | Devise | TER | Factsheet |

|---|---|---|---|---|---|

| Compte LP | Liquidités Banque WIR | – | CHF | – | – |

Obligations Suisse

| Nom | Détails | ISIN | Devise | TER | Factsheet |

|---|---|---|---|---|---|

| CSIMF Money Market CHF | FTSE 3-Month CHF Eurodeposit | CH0031419960 | CHF | 0.00% | Factsheet |

| CSIF CH Bonds AAA-AA | SBI AAA-AA | CH0033846350 | CHF | 0.00% | Factsheet |

| CSIF CH Bonds Corporate | SBI Corporate | CH0281860111 | CHF | 0.00% | Factsheet |

| Swisscanto CH Bonds AAA-BBB 1-5 | SBI AAA-BBB 1-5 | CH0215803898 | CHF | 0.00% | Factsheet |

| Swisscanto CH Bonds Corporate Responsible | SBI Corporate | CH1117196035 | CHF | 0.00% | Factsheet |

Obligations Monde

| Nom | Détails | ISIN | Devise | TER | Factsheet |

|---|---|---|---|---|---|

| CSIF World ex CH Gov. Bonds | FTSE Non-CHF WGBI | CH0033210086 | USD | 0.01% | Factsheet |

| CSIF World ex CH Corp. Bonds | BBG Barcl. Glob. Aggr. Corp. ex CHF | CH0189955260 | USD | 0.00% | Factsheet |

| Swisscanto World ex CH Gov. Bonds hedged | FTSE Non-CHF WGBI hedged | CH0117045317 | CHF | 0.00% | Factsheet |

| Swisscanto World ex CH Corp. Bonds Resp. hedged | FTSE World Inv.-Grade Corp. hedged | CH1146980946 | CHF | 0.00% | Factsheet |

Obligations à haut rendement

| Nom | Détails | ISIN | Devise | TER | Factsheet |

|---|---|---|---|---|---|

| CS Global High Yield | BBG Barclays Global High Yield Corp. | LU0340004091 | USD | 0.12% | Factsheet |

| CSIF Emerging Market Bonds | JPM EMBI Global Diversified | CH0259132105 | USD | 0.08% | Factsheet |

| Swisscanto Emerging Market Bonds hedged | JPM EMBI Global Diversified hedged | CH0398970274 | CHF | 0.00% | Factsheet |

| Swisscanto World ex JPY/CHF Infl. Linked hedged | FTSE ex JPY Glob. Infl. Link. hedged | CH0117048352 | CHF | 0.00% | Factsheet |

Actions Suisse

| Nom | Détails | ISIN | Devise | TER | Factsheet |

|---|---|---|---|---|---|

| CSIF SMI | SMI | CH0033782431 | CHF | 0.00% | Factsheet |

| UBS ETF SLI | SLI | CH0032912732 | CHF | 0.20% | Factsheet |

| CSIF SPI Extra | SPI Extra | CH0110869143 | CHF | 0.00% | Factsheet |

| UBS ETF MSCI Switzerland IMI SRI | MSCI Switzerland SRI | CH0368190739 | CHF | 0.28% | Factsheet |

| CSIF SPI ESG | SPI ESG | CH0597394516 | CHF | 0.01% | Factsheet |

| Swisscanto SMI (SPI 20) | SPI 20 | CH0215804714 | CHF | 0.00% | Factsheet |

| Swisscanto SPI Extra | SPI Extra | CH0132501898 | CHF | 0.00% | Factsheet |

| Swisscanto SPI Responsible | SPI | CH0451461963 | CHF | 0.00% | Factsheet |

Actions pays industrialisés

| Nom | Détails | ISIN | Devise | TER | Factsheet |

|---|---|---|---|---|---|

| CSIF Europe ex CH | MSCI Europe ex CH | CH0037606552 | EUR | 0.01% | Factsheet |

| CSIF US – Pension Fund | MSCI USA | CH0030849712 | USD | 0.00% | Factsheet |

| iShares Nasdaq 100 | Nasdaq 100 | IE00B53SZB19 | USD | 0.33% | Factsheet |

| CSIF Canada | MSCI Canada | CH0030849613 | CAD | 0.01% | Factsheet |

| CSIF Pacific ex Japan | MSCI Pacific ex Japan | CH0030849654 | USD | 0.00% | Factsheet |

| CSIF Japan – Pension Fund | MSCI Japan | CH0357515474 | JPY | 0.01% | Factsheet |

| CS Global Dividend Plus | MSCI World | LU0439730705 | USD | 0.12% | Factsheet |

| CSIF World ex CH – PF Plus | MSCI World ex CH | CH0429081620 | USD | 0.00% | Factsheet |

| CSIF World ex CH hedged – PF Plus | MSCI World ex CH | CH0429081638 | CHF | 0.00% | Factsheet |

| CSIF World ex CH Small Cap – PF | MSCI World ex CH Small Cap | CH0214967314 | USD | 0.09% | Factsheet |

| CSIF World ex CH Small Cap hedged – PF | MSCI World ex CH Small Cap | CH0214968353 | CHF | 0.09% | Factsheet |

| Swisscanto Europe ex CH | MSCI Europe ex CH | CH0117044658 | EUR | 0.00% | Factsheet |

| Swisscanto US – IPF | MSCI USA | CH0117044732 | USD | 0.00% | Factsheet |

| Swisscanto Canada | MSCI Canada | CH0117044864 | CAD | 0.00% | Factsheet |

| Swisscanto Japan – IPF | MSCI Japan | CH0489405321 | JPY | 0.00% | Factsheet |

| Swisscanto Pacific ex Japan | MSCI Pacific ex Japan | CH0117044831 | USD | 0.00% | Factsheet |

| Swisscanto World ex CH – IPF | MSCI World ex CH | CH0117044948 | USD | 0.00% | Factsheet |

| Swisscanto World ex CH hedged – IPF | MSCI World ex CH | CH0296590281 | CHF | 0.00% | Factsheet |

| UBS ETF MSCI EMU SRI | MSCI EMU SRI | LU0629460675 | EUR | 0.22% | Factsheet |

| UBS ETF MSCI UK IMI SRI | MSCI UK IMI SRI | IE00BMP3HN93 | GBP | 0.28% | Factsheet |

| CSIF US ESG – Pension Fund | MSCI USA ESG Leaders | CH0397628709 | USD | 0.02% | Factsheet |

| UBS ETF MSCI Pacific SRI | MSCI Pacific SRI | LU0629460832 | USD | 0.40% | Factsheet |

| CSIF World ex CH ESG – PF Plus | MSCI World ex CH ESG Leaders | CH0337393745 | USD | 0.03% | Factsheet |

| CSIF World ex CH ESG hedged – PF Plus | MSCI World ex CH ESG Leaders | CH0337393851 | CHF | 0.03% | Factsheet |

| iShares Global Clean Energy | S&P Global Clean Energy | IE00B1XNHC34 | USD | 00.65% | Factsheet |

| Swisscanto US Responsible – IPF | MSCI USA | CH1223932505 | USD | 0.00% | Factsheet |

| Swisscanto World ex CH Responsible – IPF | MSCI World ex CH | CH0215804755 | USD | 0.00% | Factsheet |

| Swisscanto World ex CH Resp. hedged – IPF | MSCI World ex CH | CH0293345648 | CHF | 0.00% | Factsheet |

| Swisscanto World ex CH Small Cap Resp. – IPF | MSCI World ex CH Small Cap | CH1220910934 | USD | 0.00% | Factsheet |

| Swisscanto World ex CH Sm. Cap Resp. hedged IPF | MSCI World ex CH Small Cap | CH1221211753 | CHF | 0.00% | Factsheet |

Actions émergents

| Nom | Détails | ISIN | Devise | TER | Factsheet |

|---|---|---|---|---|---|

| CSIF Emerging Markets | MSCI Em. Markets | CH0017844686 | USD | 0.09% | Factsheet |

| CSIF China Total Market | MSCI China | LU1815001406 | USD | 0.13% | Factsheet |

| CSIF Emerging Markets ESG | MSCI Em. Markets ESG Leaders | LU1587907855 | USD | 0.13% | Factsheet |

| Swisscanto Emerging Markets | MSCI Em. Markets | CH0117044971 | USD | 0.00% | Factsheet |

| Swisscanto Emerging Markets Responsible | MSCI Em. Markets | CH0561458693 | USD | 0.00% | Factsheet |

Immobilier Suisse

Immobilier monde

| Nom | Détails | ISIN | Devise | TER | Factsheet |

|---|---|---|---|---|---|

| iShares US Property Yield | FTSE EPRA Nareit US | IE00B1FZSF77 | USD | 0.40% | Factsheet |

| CSIF Real Estate World ex CH – Pension Fund | FTSE EPRA Nareit Dev. ex CH | CH0217837456 | USD | 0.01% | Factsheet |

| Swisscanto Europe ex CH Real Estate | FTSE EPRA Nareit Dev. Europe ex CH | CH0117052586 | EUR | 0.01% | Factsheet |

| Swisscanto North America Real Estate – IPF | FTSE EPRA Nareit North America | CH0215804730 | USD | 0.00% | Factsheet |

| Swisscanto Asia Real Estate | FTSE EPRA Nareit Developed Asia | CH0117052669 | CHF | 0.00% | Factsheet |

Matières premières

Placements alternatifs

| Nom | Détails | ISIN | Devise | TER | Factsheet |

|---|---|---|---|---|---|

| iShares Listed Private Equity | S&P Listed Priv. Equity | IE00B1TXHL60 | USD | 0.75% | Factsheet |

* Les fonds «CSIF CH Real Estate» ainsi que «Swisscanto CH Real Estate» disposent chacun d’un TER de 0.00%. Les deux investissent dans des fonds immobiliers qui font partie du SXI Real Estate Funds Broad Total Return Index. Ces fonds immobiliers ont des coûts TER qui sont indiqués dans le factsheet sous «Frais courants» ou «Total Expense Ratio p.a.».