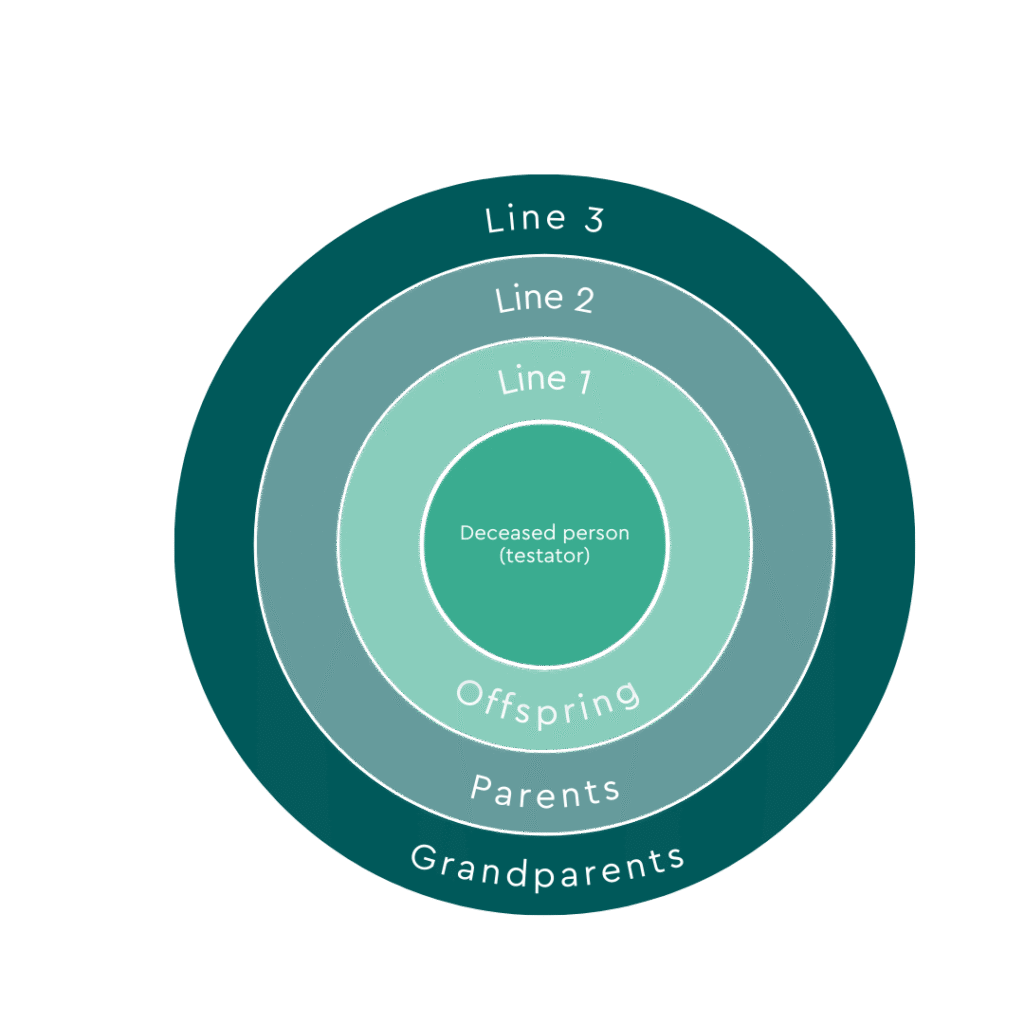

These relatives are grouped into so-called lines.

Inheritance always begins with the closest line. Only when no eligible heirs exist in a line, the next line comes into play.

- Line 1: Offspring/descendants

Children, grandchildren, great-grandchildren

→ They are the first heirs. - Line 2: Parental line

Parents, siblings, nieces, nephews

→They only inherit if no one from line 1 exists. - Line 3: Grandparental line

Grandparents, uncles, aunts, cousins

→They only inherit if no one from line 1 or 2 exists.

If there are no heirs in the third line either, the relatives’ legal right to inherit ends, and the estate passes to the canton of the deceased’s last place of residence or to the municipality designated under cantonal law.

The following graphic shows a simplified representation of the lines:

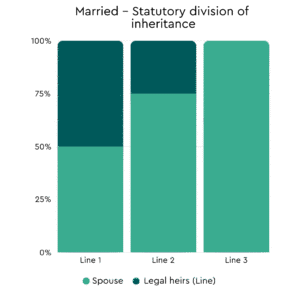

Surviving spouses or registered partners always receive a share of the estate.

This share depends on which line of the family the estate is split with:

- Line 1: Half of the estate

- Line 2: Three-quarters of the estate

- If there are no close relatives (i.e., heirs from lines 1 and 2), surviving spouses or registered partners receive the entire inheritance.

Legal succession

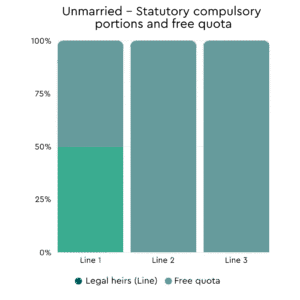

Example: Inheritance distribution when deceased person is not married and not in a registered partnership

- If a deceased person is not married and not in a registered partnership, 100% of the estate goes to their direct descendants, as stipulated by law.

- If the deceased person had no children, the parents (and their descendants) receive 100% of the estate.

- If there are no people from the parental line, the grandparents (and their descendants) receive the entire estate.

As a result, a cohabiting partner has no legal right to inherit.

Example: Inheritance distribution when deceased person is married or in a registered partnership

- If a deceased person was married or in a registered partnership and has surviving descendants, 50% of the estate goes to the descendants and 50% to the surviving spouse.

- If the deceased person was married or in a registered partnership but has no surviving descendants, the surviving spouse receives 75% and the surviving parents (and their descendants) receive 25% of the estate.

- If there are no heirs from either group 1 or group 2, 100% of the estate goes to the surviving spouse.

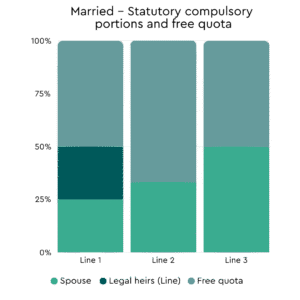

Statutory compulsory portions and free quota

During their lifetime, every person can determine how their estate is to be distributed, as long as the statutory compulsory portions are respected. Half of the estate is freely disposable and can be allocated according to the person’s own wishes (known as the free quota). Unmarried individuals can, for example, use this to benefit their life partners. It is essential to clarify the tax consequences of such a decision with a tax expert.

By creating a will or an inheritance contract (more on this in the next section), individuals can set out their personal wishes regarding the distribution of their estate.

Example: Free quota when deceased person is married

- If the deceased was married or in a registered partnership and had descendants, and during their lifetime designated their legal heirs as beneficiaries of only their compulsory portions, then the descendants and the surviving spouse are each entitled to 25% of the estate. The remaining 50% falls under the free quota and may be distributed freely as part of the free quota.

- If no descendants are left behind and the estate is divided between the parental line and the surviving spouse, the parental line’s compulsory portion is 0%, while that of the surviving spouse is 32.5%, which corresponds to a free quota of 62.5%.

- If there are no descendants or people from the parental line, the compulsory portion of the surviving spouse is 50% and the free quota is 50%.

Example: Free quota when deceased person is unmarried

If an unmarried person with surviving descendants dies, the free quota is 50%. If there are no surviving descendants, the free quota is 100% of the estate.

Personal inheritance arrangements

If the estate is to be distributed according to personal wishes, it is essential to have a will or inheritance contract drawn up.

There are three types of wills in Switzerland:

- Holographic will: Handwritten, dated, and signed

- Public will: Drawn up before a certifying officer (e.g., notary) and witnesses

- Verbal will: Only valid in absolute emergencies (e.g., in cases of acute danger to life) when no other form is possible.

A will can be amended at any time, whereas an inheritance contract is binding. Since January 1st, 2023, inheritance contracts are subject to general prohibition on gifts. This also applies to contracts drawn up before this date. An inheritance contract is a contract between the testator and one or more individuals who act as heirs. For it to be legally valid, it must be notarized.

If you want to create a will or inheritance contract, it is best to seek professional advice. This is the only way to ensure that your wishes are carried out in a legally binding manner.

Disclaimer

VIAC does not provide advice on inheritance or estate planning and recommends that all estate matters be clarified with a qualified specialist. Although VIAC has carefully researched and translated the information above, no guarantee can be given as to its accuracy or completeness. Any liability is excluded.