It is important for us to offer our customers the best value for money.

Reason 1

Fewer fees, more service

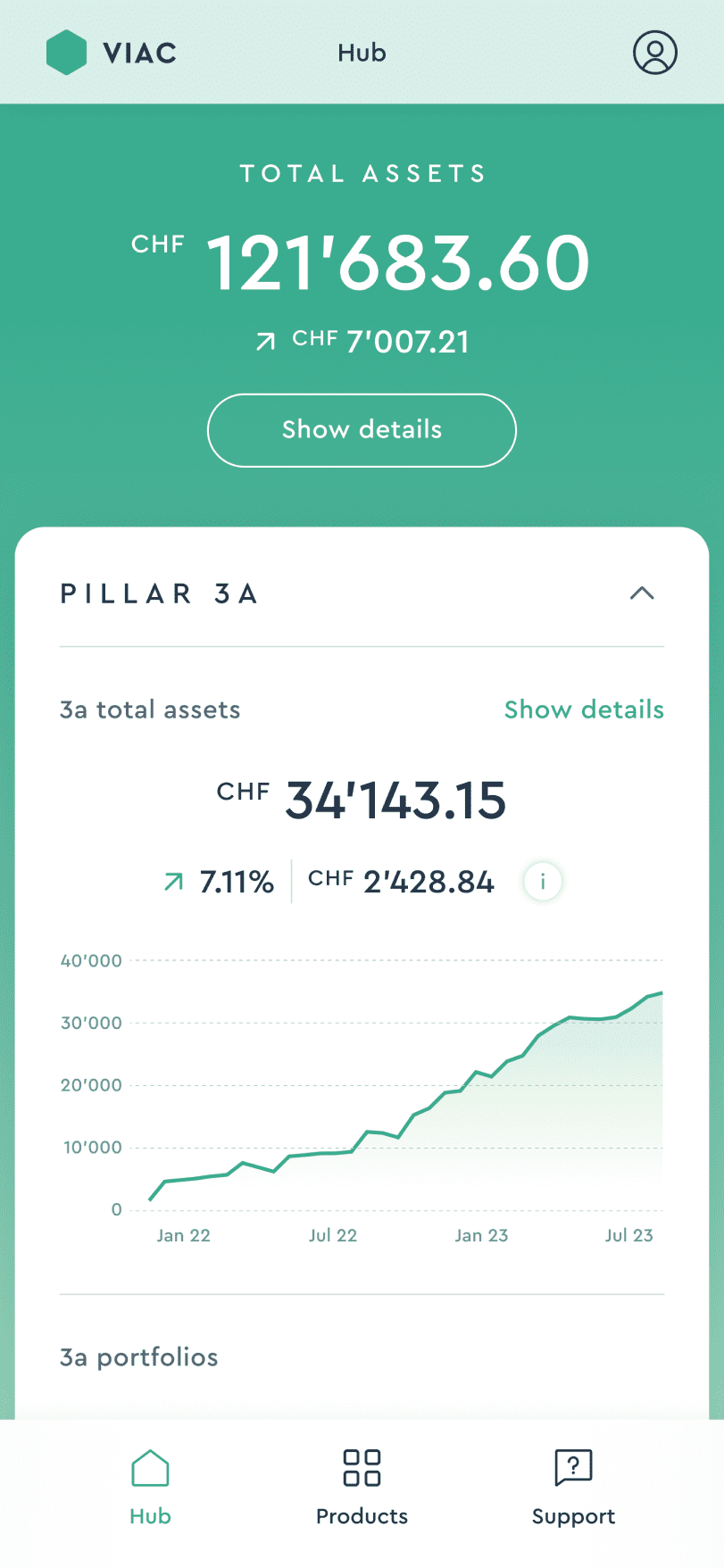

VIAC offers you the lowest average costs – 65% lower than comparable offers – with maximum benefits at the same time. Thanks to the free Life Basic, you receive up to 25% in addition to your accumulated 3a and vested benefits assets in the event of disability or death.

Reason 2

Intuitive application

Our platform is user-friendly and easy to navigate, so you can define your retirement goals and risk tolerance with precision.

Reason 3

Series test winner in Handelszeitung

VIAC's investment strategies have already been named test winner 5 times in a row. All strategies achieved a "very good" (12x) and as the only provider we could even achieve 3x "excellent".

Reason 4

Invest without an entry hurdle

VIAC’s pension solution is simple and easy to understand, even for the inexperienced – you can invest from as little as CHF 1!

Reason 5

We believe in transparency and openness

That's why we publish our investment results and fees on our website on an ongoing basis. You can access your accounts at any time and adjust your retirement plans as your needs change.

Reason 6

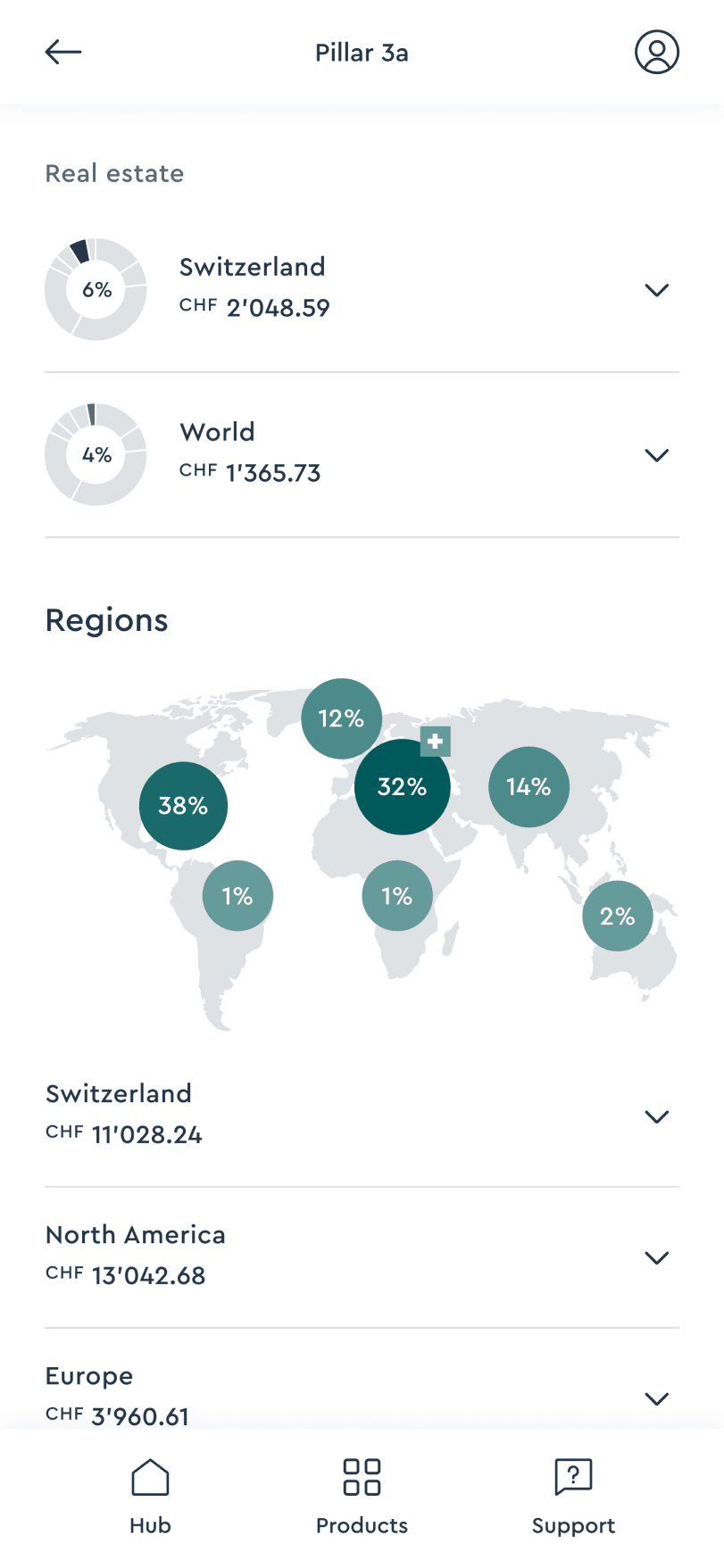

Individual strategy for professionals

With VIAC you can create your individual strategy from over 70 index funds and ETFs. More flexibility without higher costs.

Reason 7

Invest your way

Whether classic, sustainable or with more focus on Swiss equities. VIAC has a lot to offer: 6 global, 6 sustainable and 6 Swiss investment strategies.

Reason 8

Account Plus with 5% equity

Not interested in big risks but still want a return? With the Account Plus we solve exactly this problem. 95% cash with interest and 5% equity for a better return without big risks. The best thing is that it is free of charge, just like the classic 3a account!

Reason 9

Inviting friends is worthwhile

Thanks to the “Refer a Friend” bonus, we manage up to CHF 8’500 per product for you free of charge – for life!

Reason 10

Strong partners

The innovative start-up is backed by strong partners such as Bank WIR (investor, pension foundation and custodian bank for cash), Credit Suisse (custodian bank for securities and investment products), ZKB (custodian bank for securities), Swisscanto (investment products) and Helvetia (VIAC Life).