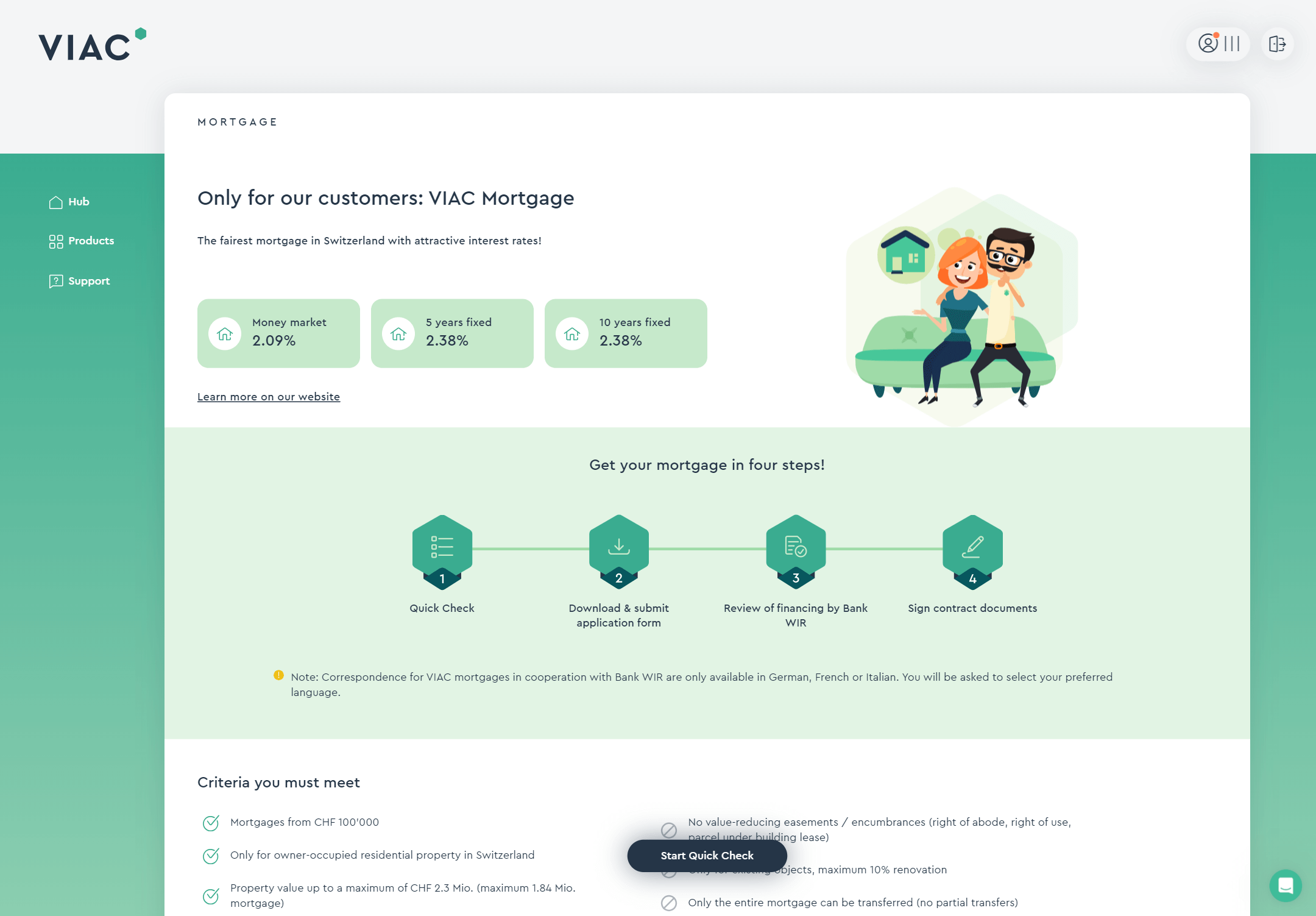

The attractive VIAC mortgage with top interest rates.

What VIAC mortgages are available?

Money market mortgage

2.33% 1

Interest rate may change every 3 months

Term 3 years

Fixed rate mortgage

1.99%

Term 5 years

Fixed rate mortgage

2.11%

Term 10 years

Note: You do not have to choose one mortgage model. You can also split your mortgage amount into up to three models (tranches).

1 The money market mortgage is composed of the margin (0.65%) and the quarterly updated average interest rate (currently 1.68%). The basis is the previous quarter, so that interest rate adjustments are always one quarter behind. This increases transparency, as the valid interest rate is already known in advance.

Disclaimer: These interest rates are the current rates offered. They can change at any time and are without guarantee. Your final interest rate will be confirmed as soon as the complete mortgage application has been received by Bank WIR.

What criteria must be met in order to benefit from the VIAC mortgage?

For a complete list of criteria, see our VIAC Mortgage FAQ.

Personal

The VIAC Mortgage is only available to VIAC users. You must be between 18 and 60 years old and a Swiss citizen or have a B residence permit or C permanent residence permit. You can conclude a VIAC mortgage with a maximum of two people.

Property

Only owner-occupied residential property at the place of residence in Switzerland is financed. The VIAC mortgage can be concluded for property purchases, mortgage repayments or renovations (maximum 10% of the property value).

Financing

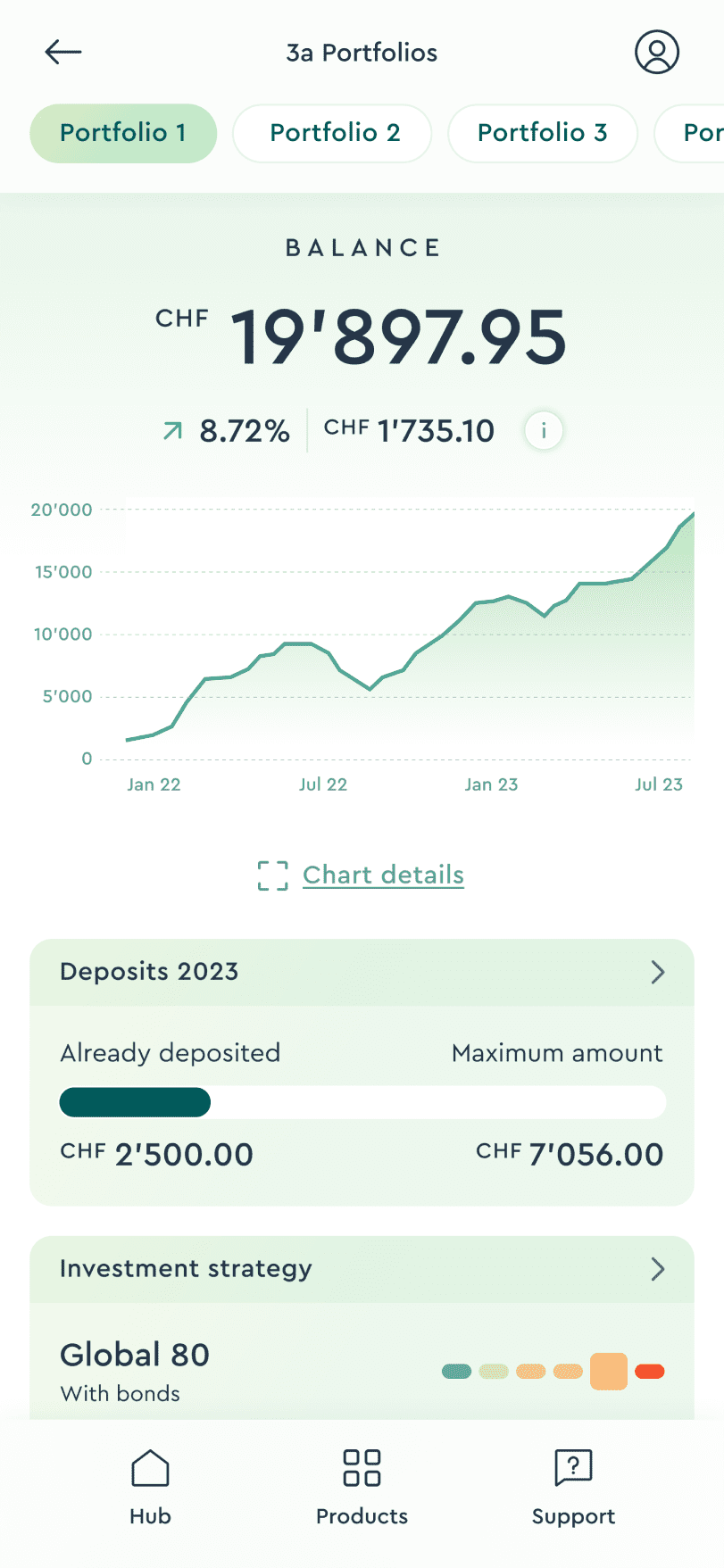

The mortgage must amount to at least CHF 100’000. In combination with your VIAC pension assets, you can finance up to 100% of the purchase price. The payment or redemption of the existing mortgage will take place within the next 1.5 years and only total financing will be provided.

Why you should choose the VIAC mortgage

Fair

No matter how high your income or your own capital is, with the VIAC mortgage all customers receive the same low interest rate. You can save yourself the hassle of negotiating.

Financing up to 100%

By pledging VIAC 3a assets or vested benefits, financing up to 100% of the purchase price is possible with the VIAC mortgage under certain circumstances. You can find more information on this topic in the FAQ.

Quick and easy

Complete the non-binding VIAC Mortgage Quick Check. Then send your documents to the credit team of Bank WIR. The credit team of Bank WIR will check your application, contact you and then send you the contracts.

Fix low interest rates

With the VIAC mortgage you can pay off your current mortgage or conclude a new mortgage within a very short time. Interest rates can be fixed up to 1.5 years before the redemption of an existing mortgage or the conclusion of a new mortgage. For 3 months the fixation is even free of charge! Read more in the FAQ.

Top partner

Our partner, Bank WIR, will process your mortgage application and pay out the mortgage. You become a customer of a Swiss cooperative bank. There are no additional costs for you.

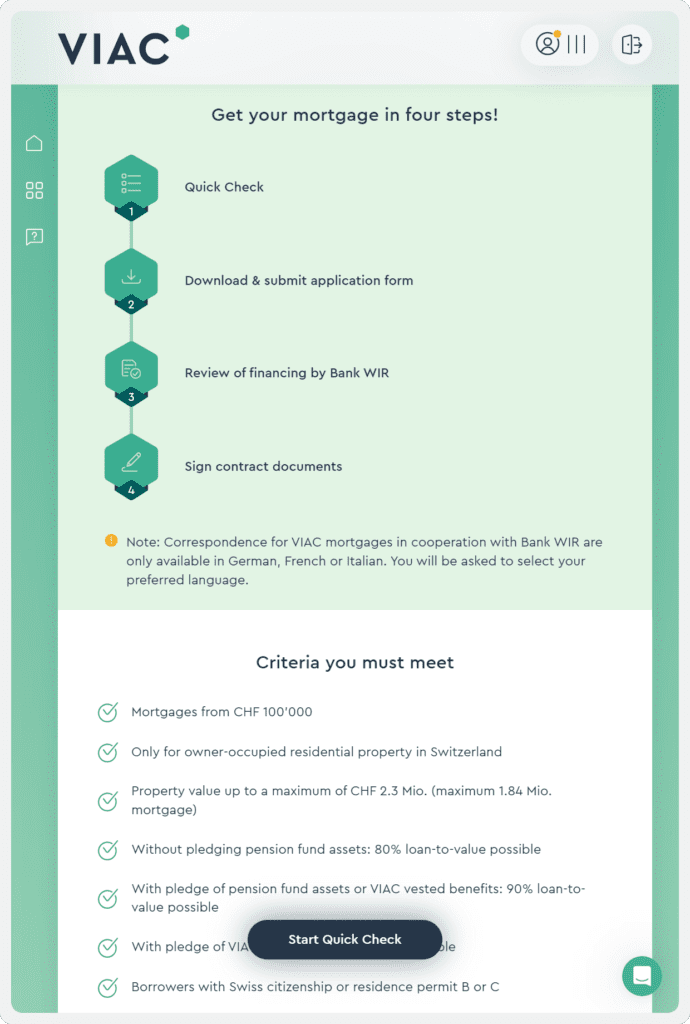

How to get a VIAC Mortgage

Use the Quick Check in your VIAC application to check whether you are suitable for a VIAC Mortgage. You can then download the application form as a PDF and send it with all the necessary documents to the mortgage provider (Bank WIR) by e-mail or post. After that, the credit team of Bank WIR will take over the further processing of your mortgage application. If financing is granted, a free mortgage and bank account will be opened at Bank WIR.