Smart investing, impressively cost-effective.

Fees

Maximum flexibility at lowest cost!

VIAC offers you the lowest average costs – over 70% lower than comparable offers – while at the same time providing maximum benefits. Thanks to the free integrated Life Basic coverage, you receive up to 25% additional payout in the event of disability or death.

Invest up to CHF 8’500 free of charge! Then 0.00% – 0.43% total costs incl. product fees

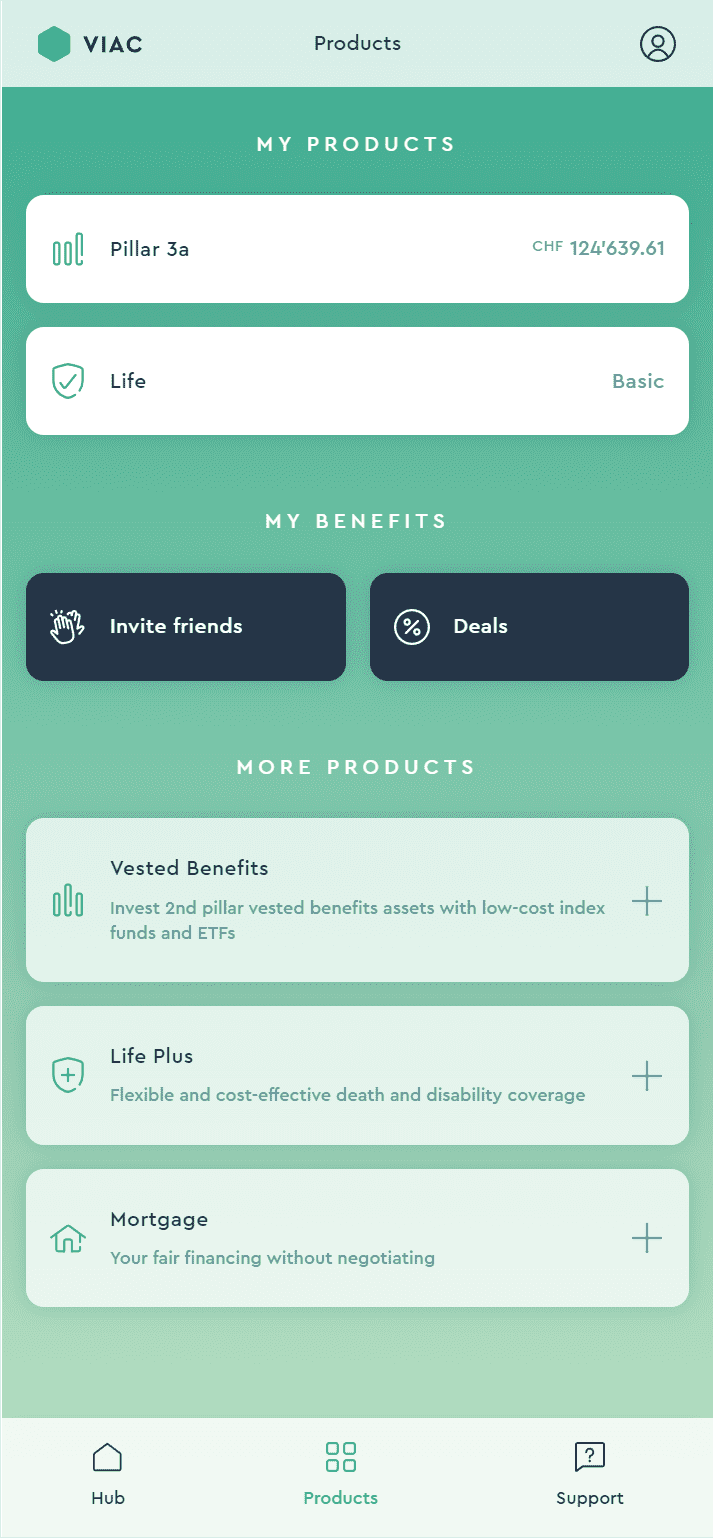

Invite friends and benefit for life!

Invite your friends to VIAC and benefit together – for a lifetime!

Every friend who follows your invitation and becomes an active VIAC client will increase your reward level. We completely waive our administration fee for the specified amount of assets.

| Get invited | CHF 1’000 | ||

| 1. | invitation | +CHF 1’000 | CHF 2’000 |

| 2. | invitation | +CHF 1’250 | CHF 3’250 |

| 3. | invitation | +CHF 1’500 | CHF 4’750 |

| 4. | invitation | +CHF 1’750 | CHF 6’500 |

| 5. | invitation | +CHF 2’000 | CHF 8’500 |

Invest up to CHF 8’500 free of charge – for life!

Total costs cover:

- Custody fee

- Product fees

- Foundation fee

- Transaction fees

- Administration fee

- Life Basic protection for disability or death

You pay no:

- Basic fee

- Retrocessions/other commissions

- Performance fee

- Closing fees (exception: home ownership promotion)

- Fees for deposits/withdrawals

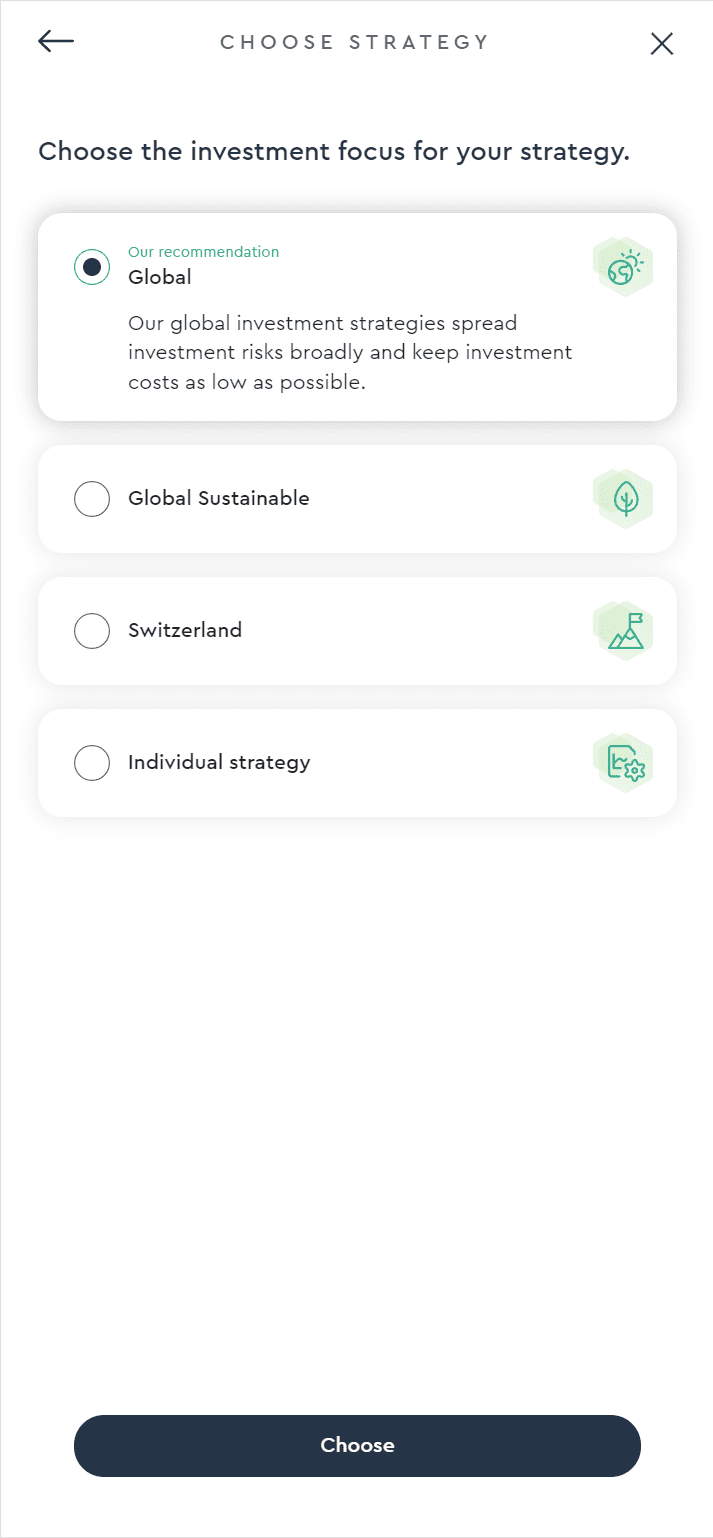

Total costs of the available investment plans can be seen under Strategies.

* Compared to the average costs (1.29%) of all securities solutions offered by SZKB, UBS, Credit Suisse, VZ Vermögenszentrum, Raiffeisen and ZKB as of 17.05.2020.

Fee calculator

You think saving one percent a year isn't worth it? Then you underestimate the compound interest effect. Save up to * more for retirement when switching to VIAC.

Expected pension savings at age

Your added value at VIAC*

CHF

* Compared to the average costs (1.29%) of all securities solutions offered by SZKB, UBS, Credit Suisse, VZ Vermögenszentrum, Raiffeisen and ZKB as of 17.05.2020.

Your added value:

The chart shows how much of the added value is lost at a competitor due to transaction costs, custody fees, product costs or lost compound interest. The effect of compound interest is particularly pronounced over a long savings period and a high expected return.

Transaction Costs

Custody Fees

Product Costs

Loss of Compound Interest

VIAC added value